Silvia Attanasio, is the Head of Innovation at ABI (Italian Banking Association). Previously to that role she worked for 17 years at ABI Labs, the centre of research and innovation at ABI. Previously Silvia introduced us to Spunta, the private permissioned DLT project for interbank reconciliation. In this podcast she shares with us some of the work that ABI and its consortium of Italian Banks are looking to offer to the European Central Bank in its development of its CBDC called the Digital Euro.

What is blockchain?

Blockchain is a disruptive technology that can deeply transform the way we transact. It may add transparency and eliminate frictions in transactions. Blockchain is not a cost cutting technology. It is a technology that can bring some efficiency gains in due course. Blockchain technology can transform processes

Update on Spunta

Silvia featured on Insureblocks on the 22nd March 2020 where she introduced Spunta, a private permissioned DLT project for interbank reconciliation.

The new application streamlines and automates the reconciliation of transactions, improving governance of the overall Spunta process, a nostro vostro account, and moves from a slow error prone settlement system to a real time management of the reconciliation process.

Today after three waves of migration, nearly 100 banks are in production operating the Spunta DLT daily. Each bank has its own DLT node, geographically distributed in nine different cities across the country processing 322 million transactions.

Introduction to Central Bank Digital Currency (CBDC)

The term CBDC denotes money that a central bank could create in digital form and make available to the general public. It would not be another currency, it will be another form of the existing currency.

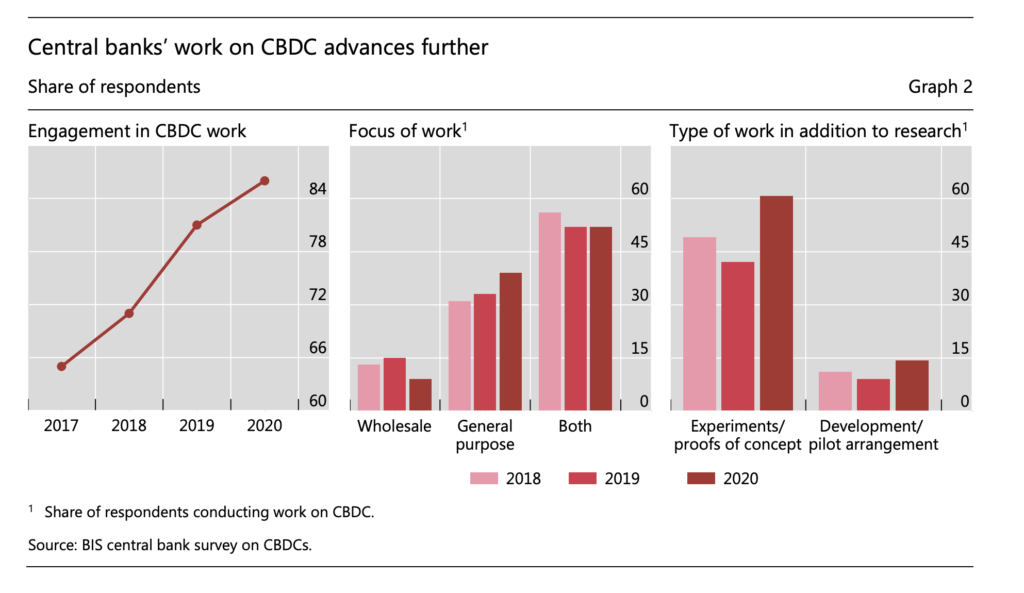

In January 2021, The Bank of International Settlement ran an updated survey with central banks around world. In it they found that 86% of central banks are engaged in CBDC work. P from 80% in May 2020. Central banks representing 1/5 of the world’s population are likely to issue a retail CBDC in the next three years.

The goal of improving financial inclusion is much more pronounced in emerging economies, while it is less present in advanced economies like European Union, where the main objectives are the security and efficiency of the payment system.

The Digital Euro

The European Central Bank’s CBDC is called the Digital Euro. The ECV see’s three main benefits in exploring the possibility of launching a Digital Euro:

- Support digitisation for a native digital European economy

- Respond to the declining usage of cash as a means of payment.

- Tackling sovereignty concerns related to foreign private digital means of payments in the euro area or possible future foreign CBDC

There are a few more benefits from the bank’s perspective that Silvia highlighted such as the possibility of enabling use cases based on the programmability of the currency, and the possible application to transactions from counterparties as a machine.

Preserving properties of cash, anonymity and privacy in a Digital Euro

Fabio Panetta, Member of the Executive Board of the ECB stated that in a blog post: “Central to all our discussions is the fact that a digital euro would be a means of payment that would complement cash, not replace it. Abolishing cash is not on the table, as ECB President Christine Lagarde and other members of the ECB Board and Governing Council have stated publicly on several occasions.”

With regards to anonymity. If the identity of Digital Euro users were not verified at any stage of a transaction then they would be anonymous and AML / CFT mechanisms (anti-money laundering / combating the financing of terrorism) wouldn’t be effective. Silvia believes that this would require at least a light identity verification when opening a digital wallet. However as the implementation of a Digital Euro may happen on a DLT platform it is possible to ensure that the information related to the individual is exchanged on a need to know basis. So only the two banks involved in a transaction will have access to the information.

ABI’s 10 considerations for a CBDC

The Italian banks experience in the Spunta project gave them the necessary competences and understanding of what could be possible with CBDCs. ABI has prepared 10 considerations for a CBDC which can be summarised into three main concepts:

- The digital euro must be functionally different from an electronic payment instrument in order to complement and not to compete with commercial bank money.

- In order to be complimentary and not competing with electronic payment instruments, in the same way that as today, banknotes and coins as well as the different payment instruments are providing an array of choices of choices to the customers and are not competing, it would be useful to start by defining potential synergies with existing payment instruments. A Digital Euro built on DLT, thanks to the programmability could allow banks to deliver and propose new service.

- In terms of accessibility and ease of use, since all citizens have the right to access the physical euro, they must have immediate perception and awareness that they are using a digital euro.

ABI’s prepared 10 considerations for a CBDC (source ABI):

- Monetary stability and a full respect of the European regulatory framework must be taken into account as a priority.

- Italian banks are already working on a distributed ledger infrastructure thanks to the Spunta DLT project. They want to be part of the change that comes from such an important innovation like digital currency.

- In the financial environment, a programmable digital money represents an innovation that’s able to profoundly modify the way we conceive currency and exchange. This transformation can potentially deliver a great added value in terms of efficiency for both operational and support processes. This is the reason why it is so important to dedicate attention and energies to develop, quickly and in collaboration with the entire ecosystem, new instruments able to primarily support the development of the Euro area.

- It is necessary that digital money deserves the maximum trust from the public. To this extent, it is essential that the highest standards of regulatory framework, security and supervision are fully respected.

- Thanks to the key role played by the Central Bank, a CBDC represents the instruments that, more than others, can satisfy the innovation needs in alignment with the current framework of rules, existing instruments and interoperability with the analogical world. At the same time, an instrument like this may reduce the attractiveness of analogue tools issued by private or (in the fully decentralized implementation) non identifiable actors, due to a higher inherent risk.

- To deliver at its maximum the potential of transformation of such kinds of tools, it is of absolute interest for the possibility, currently under consideration, to issue a retail European CBDC, that can represent an innovation of cash. Thanks to the role of banks, it is possible to identify technical solutions and an operational framework able to preserve the current characteristics of cash, while adding several typical benefits of the digital world (already satisfied by digital payment instruments), such as the ability not to lose money and, in this period where sanitary risk is under the spotlight, to operate contactless.

- Analysing every detail, it would be possible to define how to distribute, store and exchange digital money in a way that enables banks to combine customer needs, together with the ability to ensure that the monetary policy is transmitted to the real economy and compliance to the regulatory framework. For sure, in each of these objectives, The banks role is crucial.

- A key success factor for the adoption of CBDC is to reach a frictionless user experience, ensuring, at the same time, full interoperability between digital and analogical worlds and a complete circularity among all ecosystem actors.

- According the technological choices that will be taken, a particular attention to the protection of personal data of our citizens is required (privacy).

- Thinking to the future that awaits us, the availability of a CBDC will enable several very interesting use cases: to foster peer to-peer value transmission, supporting money exchange between person and machine and in a machine-to-machine scenario; to facilitate cross-border transactions settlement, reducing interest rate, exchange and counterparty risks; to promote, thanks to the programmability of this instrument, the automatic execution of payments when predefined situations arise, reducing administrative processes.

Learnings from Spunta

ABI gained three key findings from their work with Spunta:

- Distributed ledger technology implies distributed governance

- Straight from the beginning it is important to work in a collaborative manner

- If DLT is a disruptive technology we need to accept and embrace the disruption

In their view the design of a Digital Euro requires careful reflection on the adequacy of traditional governance models that have been applied for infrastructure projects led by the ECB and the Euro.

The digital euro will deeply affect customers, payments, services, processes, and ICT solutions of the payment service providers in Europe.

From this perspective, the banking sector and other providers of retail payments are in the best position to assess potential effects of architectural options on the end users and to quickly evaluate the feasibility on actual payment services. The Italian banking sector would like to share their experience and expertise gained over the last few years with Spunta in particular the infrastructure itself and the distributed governance aspects that proved to be key determinants on the project success. They believe that the set of experiments based on coopetition principles brings great benefit to the market, particularly in the context of distributed paradigms.

Four possible use cases

ABI, along with 18 banks, has spent the last two months developing four possible uses cases to understand the impact of a programmable digital Euro:

Simply Home

Performance of multiple payments expected at the time of purchasing a property through the granting of a mortgage. The execution of payments (to the seller, to the agency, to the notary, to the seller’s bank to pay off a previous mortgage, etc.) through the enabled functionality of making a single transaction divided into multiple payments will simplify and automate the management of transactions towards the various actors involved in the process of buying and selling a property. The distinctive feature of this use case lies in the maximum exploitation of the digital euro as a central bank liability as well as in the combination of two feature of programmability the execution of multiple payments in a single transaction and the possibility of limiting the expandability.

Safe Return

The process of returning a purchase made through an e-commerce. Thanks to the implementation in a distributed ledger of instructions that are binding and executable only on the occurrence of predetermined conditions (so-called Smart contract), it is possible to make the process of returning purchased goods more reliable and consumer-friendly. At the time of delivery of the returned goods by the client, the sum of money can be blocked and kept in an escrow account, which only releases it after confirmation or rejection of the return.

Culture Pass

Culture Pass is related to the bonuses provided by the Government to support some kind of expenses: the development of this case will lead to the creation of specific smart contracts linked to the Digital Euro, which will allow to encode the logic and purpose of expendability of these tokens, making it possible to use the bonus only in compliance with the terms and conditions indicated by the issuing entity. In addition, a simplified prototype linked to the management of sums to minors (pocket money) will be developed, in order to limit the usability only to the categories of purchases allowed by law.

Pay & Split

Execution of payments for products on consignment. The case provides for the transparent management of the execution of payments for products on consignment in the so-called short supply chains, using the functionality of “split transaction” (atomic and instantaneous transactions). At the time of purchase, a single transaction is divided so that payment is directed to the seller of the product and to the various producers making up the supply chain.

___________________________________________________________________________________________

This episode is brought to you by our friends and sponsors at R3, one of the pioneers in the Spunta collaboration to provide a faster, more efficient and more transparent way of reconciling interbank transactions.

Visit R3.com to find out how Corda, R3’s enterprise blockchain platform has been adopted as the platform of choice by Spunta and for other innovative blockchain projects across multiple industries including insurance, trade finance, supply chain and capital markets.