Antony Elliott, is Chairman at B3i and Group Head of Business Transformation at Zurich Insurance. In this podcast we discussed innovation in the insurance industry, blockchain as part of the new stack, but also what he feels were the lessons learnt at B3i and what his aspirations are for it.

At Zurich Insurance, Antony is focused on making the organization more effective, efficient and customer centric. As he suggests, his role at B3i has a similar focus except at an industry-level. Thus, his dual roles allow him the ability to drive transformation at a group and industry-level; an opportunity few have!

What is blockchain?

According to Antony, blockchain is a tamper proof protocol that allows information to be shared across a distributed platform. From an insurance perspective, blockchain permits better allocation of capital to risks by allowing mutually distrusting parties to be part of the same network and extract benefits from referring to a single source of truth.

B3i from Antony’s perspective

B3i began as an industry roundtable to discuss blockchain and was eventually incorporated as a company in 2018 which is owned by seventeen insurance companies. The wider B3i community consists of 40 insurance entities including primary insurers, brokers and reinsurers. It’s mantra is for the market by the market. The aim at B3i is to build protocols, standards and infrastructure to remove friction in risk transfer in order to better allocate capital to risks.

Antony’s journey

Passionate about transforming the insurance industry inside and outside of Zurich insurance.

Antony was introduced to the insurance industry during his early days on the graduate scheme at PwC back in 1999. His initial experience with insurance was in PwC’s assurance practices which involved audits and consultancy work.

He believed then (and does till date) that insurance is a social good. However, he continues to believe that there are ways to make insurance better for customers. Antony’s LinkedIn handle summarizes his vision as “passionate about transforming the insurance industry inside and outside of Zurich insurance.”

Innovation in insurance

Antony points out that the insurance industry has made substantial progress with regards to innovation over the past 5 years. The focus on innovation is gradually shifting from the product side to becoming centered around the customer. Antony makes an interesting remark that “line of business” (a phrase widely used in insurance companies) bears no relevance to the customer!

As of June 2019, Zurich has created the role of Chief Customer Officer – Conny Kalcher was recently appointed to this position. This role may be viewed as that of a customer advocate within the organization. Another area that the insurance industry is improving is with a focus on innovation and engagement with startups. In general insurance is pretty good at developing proof of concepts but have a harder time at scaling innovation. Zurich is attempting to do it differently and Antony proceeds to highlight some examples of incumbent engagement with technology recently. In particular, he mentions Zurich’s acquisition of Bright Box in December 2017. Bright Box focused on telematics for OEMs which augmented Zurich’s effort in the telematics-based motor insurance category. In March 2019, Zurich partnered with start-up riskmethods within the supply chain space. In addition to these partnerships, Zurich conducted its Global Innovation World Championship in 2018.

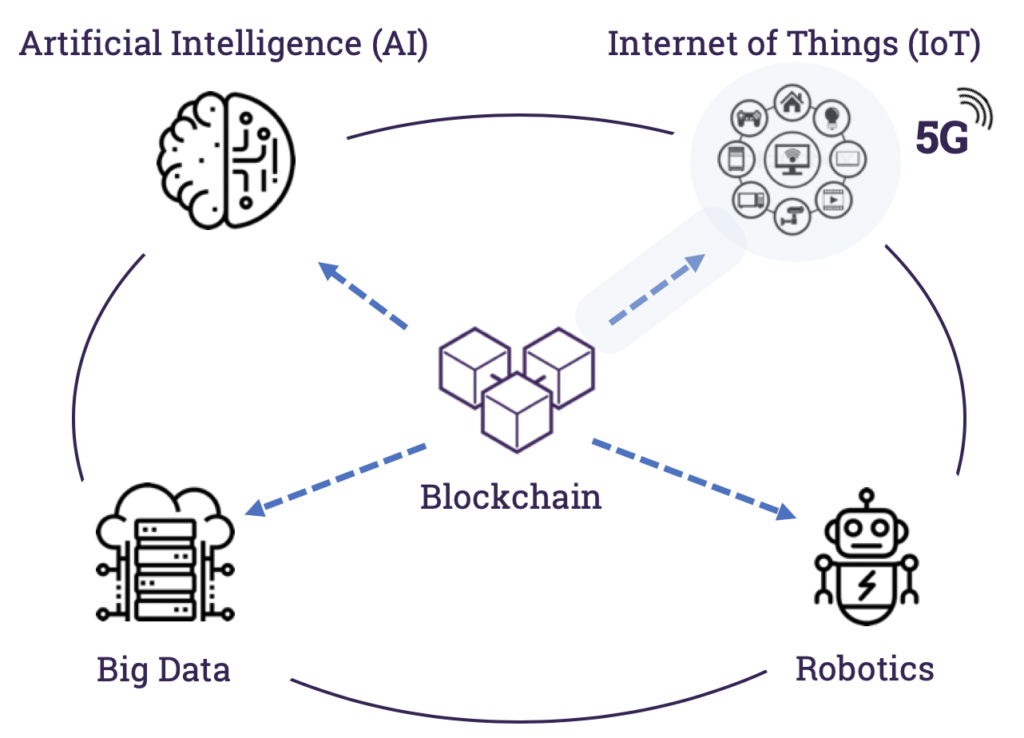

Blockchain as part of a new stack

Antony shares Insureblocks’ view that emerging technologies such as blockchain are part of a new stack. He takes the example of a connected home insurance service where a blockchain based ecosystem together with IoT devices (in homes) and AI (to analyze data) will be required.

Blockchain will provide a single source of truth to various participants in a connected home insurance service – this ecosystem would involve home owners, facility managers, service providers (electrician, plumber etc), emergency services (fire brigade, ambulance) and insurance value chain participants.

He is quick to point out that data ownership is an excellent question. Since data will be generated by on-site IoT devices, it remains unanswered as to whether data ownership resides with the OEM (original equipment manufacturer), end customer, insurance company or other service providers. What he is certain about is that it is important for insurance companies to be able to extract the signal from noise (given the large volume of data produced) and determine risks accordingly.

Journey leading to B3i

Antony was not present at the first B3i roundtable discussion in 2017 but was, as he puts it, a “fast follower”. Blockchain presented Antony with an opportunity to approach insurance differently.

He further points out that DLT will, like the internet, become an infrastructure level technology upon which applications can be built. He highlights that during his childhood, he was fascinating when his father brought home a video recorder and notes that his children don’t understand the concept of live television (he believes DLT is still a maturing technology and is in the “video recorder” stage of where live television was).

B3i is focused on providing a platform upon which the insurance industry can transact. One of Antony’s key learnings is that it is important for all insurance value chain participants to be involved in activities concerning an ecosystem. Although brokers and reinsurers were not present at B3i’s initial talks, they are now part of the B3i network. He points out that there is a need to further diversify the board to include representatives from brokers.

B3i & brokers

If there’s any brokers listening and they’d like to have a conversation about becoming part of a family, we’d love to hear from you.

In answering the question “What do you believe the B3i team has gotten right up to now and what can they improve on?”, Antony highlights some of the great achievements the B3i team have done to date. The one area he felt B3i didn’t quite get right is that in the original roundtable conversation it only included insurers and reinsurers. Brokers weren’t around the table at the beginning and as a result they’re not quite present at the board table at the present stage. Antony would love to have the brokers engaged at the board table to discuss B3i’s strategy, development of the reinsurance and commercial insurance products.

Recent SBI investment

In May 2019, Japanese firm SBI Group invested $1.9M into B3i. Antony states that conversations with SBI regarding the Japanese market have been useful and new investors brings new ideas to the table. The CEO of SBI shares B3i’s view that DLT will change how financial services works

Your Turn

Thank you, Antony, for speaking with us regarding B3i, Zurich Insurance Group and how DLT will become a driver for innovation in the insurance industry centered around the customer. If you liked this episode, please do review it on iTunes. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below. If you’d like to ask Antony a question, feel free to add a comment below and we’ll get him over to our site to answer your questions.