For this week’s episode, we’re once again connecting with Christopher G. McDaniel the President of The Institute RiskStream Collaborative. In this episode, Christopher gives us an insight into the concept called risk singularity. We discuss the 3 phases that he envisions will preclude the risk singularity and what it means for insurers.

What is blockchain?

Christopher defines blockchain as a mechanism where information can be shared between different parties who without this mechanism wouldn’t normally trust each other. What this gives each of these parties is a trusted mechanism. Once widespread, they’ll be no need for information to travel back and forth between different parties. Through this mechanism, everybody in the network will now have the data ubiquitously. When this data no longer needs to be transacted between different parties continually it opens up new possibilities for insurers.

The Institute RiskStream Collaborative

The Institute RiskStream Collaborative is a non-profit consortium. It’s a collaboration of close to 50 members, made up of some of the largest insurance carriers and reinsurers globally. The goal is to build real-world applications and use cases using emerging technology

Risk singularity

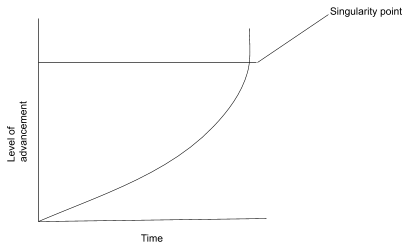

So what’s meant by the risk singularity? First, the term technology singularity was made prominent by Sci-Fi writer Verner Vinge who in 1993 predicted that within thirty years, we will have the technological means to create superhuman intelligence and Ray Kurzweil through his book entitled ‘The Singularity is Near’. The term refers to a hypothetical point in time where technology advances to a tipping point and past that point technological growth becomes unpredictable and irreversible. Christopher defines risk singularity means that we get to a point where data, intelligence and process transformation have become so advance that the risk management industry undergoes a dramatic and irreversible change.

The impact of risk singularity to insurers

Over the next 15 to 20 years Christopher believes the following

- There’ll be a shift in that the majority of data will come to the company externally as adverse to what’s happening now where the majority of data comes from internal sources such as actuarial tables.

- It’ll mean that insurers aren’t the ones to own individual’s data. Christopher envisions that eventually the individual will own their data on the personal lines side of insurance companies and individual’s will choose if they share it.

- If risk singularity occurs and data comes from external sources Christopher foresees more of a blurring of insurance business lines. Today everything in the industry is very siloed. Life insurance is siloed. Car insurance is siloed as are commercial lines. When data is available from numerous different external sources, new solutions will emerge that will cut across different insurance sectors and geographies.

- Solutions could be provided by any insurer worldwide as long as they’re in the network. According to Insurance Business UK based on the metric of net premiums written (NPW) in 2019 UnitedHealth Group based in America was the largest insurance company with $158.5 billion NPW. Second, AXA based in France with 104.5 billion NPW and third China Life Insurance Company with $97.6 billion NPW. None of these countries have a large presence outside of their areas. If consumer data is uploaded to a blockchain ledger and they’re in the network they’ll be competing directly.

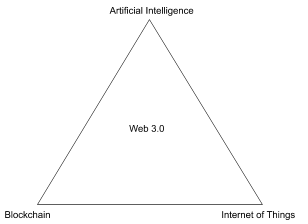

For the risk singularity to be enabled what is referred to as the Web 3.0, the combination of blockchain, AI and internet of things (IoT) needs to happen.

Blockchain as a data sharing mechanism is the foundation. It is where the data will be uploaded onto the network and shared between the different parties. Along blockchain you will have AI and IoT. AI’s role will be analysing the data coming into the ledger to see what is valuable and can be used by the insurers. IoTwill be the external source of the data, and from 2019 to 2025 they’ll be 48 billion more IoT devices according to Statista. These ‘things’ will come many forms such as smartwatches like the Apple Watch, doorbells such as Ring and smart meters.

It is the combination of the data shift, the blurring and the breaking down of barriers between sectors through the use of blockchain, AI and IoT will encourage the transformation of insurance processes.

The 3 phases before the risk singularity

The three phases are each given a 5 years time span.

- Ubiquitous data- This refers to data sharing through an industry-wide blockchain. This explains the importance of blockchain particularly in the early years as data will need to be shared and viewed by different parties.

- Ubiquitous information- This is the major shift of when information comes from external sources instead of within the insurance company itself. For this phase to happen IoT devices need to be widely dispersed. There needs to be a mechanism for getting information from the device to the blockchain and standards and regulations to ensure the data isn’t misused.

- Ubiquitous intelligence- This is through the use of AI and blockchain to complete all of the processing is instantaneously. Ubiquitous intelligence will be completely frictionless and invisible to the consumer.

Now, the data that comes to the insurance companies from outside sources needs to be turned into usable data for the underwriting process. After these three phases, Christopher argues that the data will come directly from the external sources and this will be the data that is used to make valuation decisions instantaneously. An example of how this could work. If a person has a modern car with sensors and they drive safely in a safe area then the GPS and sensor data is transferred to an AI system where the data is analysed. When it concludes that the person is a safe driver then it’s updates the blockchain ledger and their premiums are instantaneously reduced.

Data sharing in the insurance industry

The mentality of insurance companies at the moment is to hoard the data within the company. The companies that decide to hoard and silo data to themselves and not engage in the network will be at a disadvantage. They’ll be alternative blockchain networks where much more data is being shared and it will become a necessity for organisations to join a network and have access to this data.

Process changes

Assessing risk is a timely process. It can take days to assess risk through the current underwriting process. Once risk can be assessed in real-time through Web 3.0 this will open up a host of opportunities. Reinsurance is a complex and prolonged process. If reinsurance could be provided instantaneously it could mean that reinsurance could be provided to cars, boats and even people.

Risk singularity impact on business models

The risk singularity will completely change the business models of insurance companies. A business model describes how an organisation creates, delivers and captures value according to Alexander Osterwalder and Yves Pigneur. Now, generally, insurance companies compete to produce value through customer service and user experience. Where Christopher envisions value being provided in the future is providing a whole variety of different insurance business lines. Insurance companies will be competing to offer value on the processes more than the customer experience.

Top tip for preparation of the risk singularity

Get involved. Right now a lot of decisions around ubiquitous data are being made that will directly impact risk management firms. The Institute Riskstream Collaborative are very open to insurers becoming part of the conversation as to which direction they should head in.

__________________________________________________________________________________________________

This episode is brought to you by our friends and sponsors at R3.

Today’s insurance industry faces a number of challenges. Data sources are disparate, the claims process is complicated, billing systems are archaic, and inefficient processes lead to high reconciliations costs, ambiguity in loss conditions and settlement delays. Let’s be honest, it’s not great!

Here on the Insureblocks podcast, you’ve heard about numerous use cases from insurance providers and InsurTech companies implementing blockchain technology to streamline operations and lower expense ratios from back-office operations.

R3’s enterprise blockchain platform, Corda, has been adopted as the platform of choice by many of these innovative insurance and technology companies around the world and is already helping to solve real industry issues.

If you want to find out more, why not register for R3’s Executive Round table in London on 13 Feb – Check out r3.com/event for details.