In this exciting podcast, we are joined by Bruce Pon, co-founder of Ocean Protocol, to discuss how to monetize and tokenize data. Almost 6 years ago Bruce and Trent McConaghy, previously on Insureblocks regarding “The Data Economy”, got into the blockchain space by seeing how the concept of Bitcoin could be applied into non-financial use cases like data.

What is blockchain?

Bruce, refers to blockchain as a general purpose technology. He states there are only about 30 to 35 general purpose technologies that have ever been discovered on Earth, by humankind. You start off with agriculture such as the domestication of plants and animals to the steam engine of the industrial revolution to electricity and railways to the last century. In this decade we’re going to see things like AI, blockchain, bioengineering infuse themselves across the entire world.

At the highest level, blockchain is one of those fancy technologies that is going to change the world over the next 30 years. At a more in-depth technical level it is a way use technology where you don’t need to trust an authority.

Bruce read an interesting concept which states that it was science in the Enlightenment era which took us away from believing in authority, the Supreme kind of knowledge of authority from priests and/or kings. That Enlightenment era made us take a different methodology for understanding the world around us, which was the scientific method. Blockchain is taking us away from believing that we need a central intermediary to hold things of value for us like a bank, like a government, or any other enterprise that holds for instance our data. Blockchain allows for data to now be held in a way that there is no authority to control your own data.

Just like the internet 30 plus years ago allowed the general public to get access to information in a way that was never before possible. Blockchain is going to allow us to get access to control our own assets in a way that was never before possible.

Ocean Protocol

In 2013 Trent McConaghy and his wife found the idea of Bitcoin as an interesting global database that allows people to have perfect knowledge about who controls what? Along with Bruce they found that this could be applied to intellectual property with copyright. Who owns the copyright? Who owns the rights to control the distribution of music or books?

In 2014, they started a company called ascribe to do exactly that to try to put intellectual property copyrights, trademarks, all these types of things on the Bitcoin blockchain. 18 months later they realised that Bitcoin wasn’t the appropriate infrastructure for metadata for copyrights. They then created BigchainDB, a database that was built on blockchain technology to store metadata to solve the problem with ascribe. After running 50 to 100 industry proof of concepts they came to realise that who needs data with provenance? Who needs control of their data? It is either the people providing the data and/or trying to sell the data to the AI consumer. As it is AI that is actually absorbing all the data in order to feed its algorithms. The more sources of data, the better the AI algorithm. If provenance, ownership, and origin of data can be ensured then you have the potential to change the economic model for society when it comes to non-financial use cases such as intellectual property.

Bruce recounts how in the mid 90s there was a valuation made of all the land and all the intellectual property in the world. It turns out that their respective valuations where roughly equal. The only exception was there wasn’t a proper mechanism for valuing intellectual property nor was there the infrastructure to track who owns what.

Blockchain provides the infrastructure to track ownership of intellectual property globally. With the increase growth to the service economy, the knowledge economy is now going to be valued in a way that wasn’t possible. Ocean Protocol in a nutshell is trying to make that bridge between the current world where if you share something on the internet, it’s gone, there’s no value. With Ocean Protocol, you have the provenance of the data, a means of exchanging value and money for that data and intellectual property.

Ocean Protocol’s goal is to make it so that every individual, just like with Bitcoin can take control of their data and their intellectual property.

An Uber for data

What Uber has demonstrated is that if you could get this kickstart of suppliers and consumers for unmet demand, you can make things happen. They created a liquid market of drivers, and consumers riders.

Today it’s really difficult right for people to get liquidity in data. To buy data, to consume data and to make it available without making it for free. How do you get it so that somebody can start sharing data in a more free and open manner without the authority? And how do you get a consumer to discover that data in a more free and open manner without the authority? Once you crack those questions you can have liquidity. With liquidity, you have price signal, and you have a viable ecosystem.

That’s what Uber has done. They have so much ride sharing data from where cars are going to how much people are willing to pay that they can price taxi rides advantageously over the incumbents who don’t have those smart systems. Uber has that information to make a liquid market viable. Bruce argues that we need that for data. Who is going to be the Uber for data who ensures that there are multiple platforms for the sharing of data that is not controlled by any authority that allows for people to start discovering the price of data.

How can enterprises value their data?

Bruce argues that enterprises are going to have to take a half-open and half-closed approach to sharing their data.

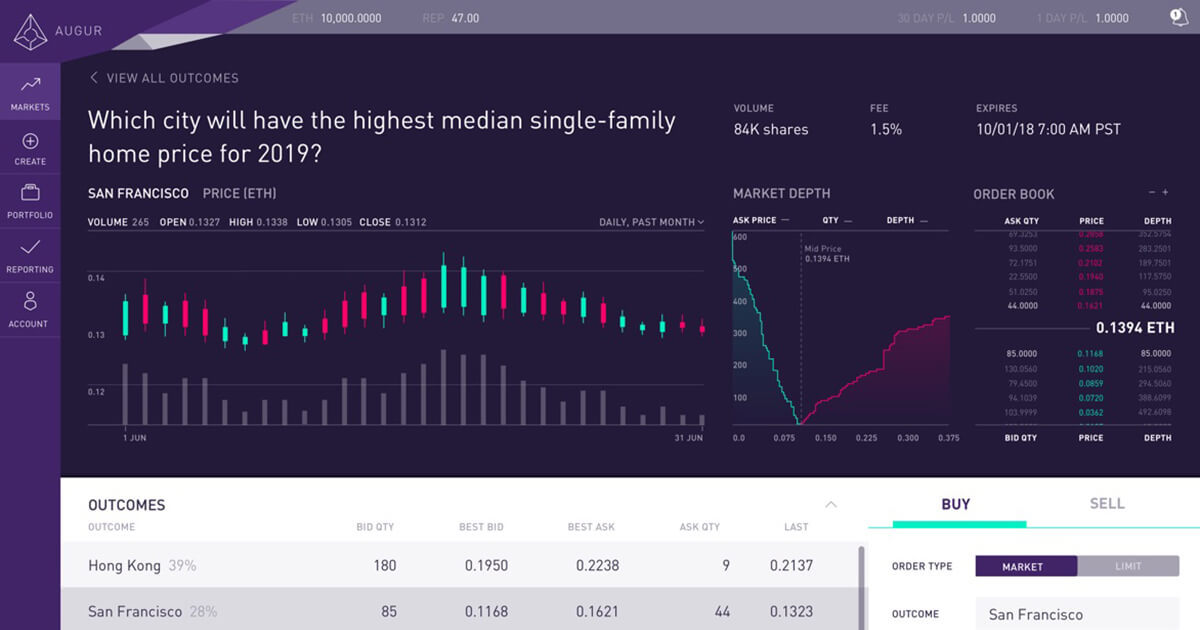

Couple of ways to put a price on data: betting markets such as Augur that involves the crowd placing bets and essentially pricing data. Augur like others are built on top of Ethereum and provide a good indicated for open data.

For close data we go back to 2000, Goldcorp – a Vancouver-based mining firm – launched the Goldcorp Challenge. At the time, the company’s mine in Red Lake, Ontario was underperforming and producing only 50,000 ounces of gold a year. In spite of this, the company’s geologists were certain that the main gold deposit lay deeper underground.

Since they did not know where to begin looking and any exploration process was likely to be time-consuming and expensive, Rob McEwen – Goldcorp’s CEO – decided to do something bold. Inspired by an MIT conference he attended in 1999 – where the story of how Linus Torvalds used the Internet as a collaborative resource to build the Linux software operating system – McEwen decided to crowdsource a solution. McEwen made the company’s geological data available to the public, and offered an incentive prize of $575,000 CAD to anyone who could locate the untapped gold deposits. Within a few weeks, over 1000 submissions came in from all over the world and the winning team produced a map which Goldcorp used to identify 110 deposit sites in the Red Lake mine, 50% of which were previously unknown to the company.

These unearthed deposits were worth more than $6 billion, and shaved two to three years off the company’s exploration time. But most importantly of all, the discovery turned what was a struggling mining company into the most profitable in the business. This is the power of data and when a company choses to open up its data.

The building blocks to unlocking this potential are around framing, financialization, infrastructure, & protocol.

Framing – data as intellectual property and providing liquidity to it

In a medium article entitled “How to monetize & tokenize data”, Bruce, explains that data is intellectual property. Because data is intellectual property, copyright law applies to it. Over the last 70 years the world has harmonised copyright laws. Once you frame data as being intellectual property with applicable copyright laws it allows to put a financial value and control over it.

The financialization aspect is, once you have an asset, like intellectual property, there are ways for people to make money off it. Currently this is very hard, because the infrastructure is still immature. The only people who’ve been able to financialize their data and their intellectual property are organisations like music labels or Netflix or Reuters and Bloomberg. They can do a couple things with it. They can turn that into a bond for a recurring revenue which can be securitized. There are a couple of ways where that data stream can be monetized.

Now we have decentralised infrastructure that allows for monetizing of data streams built on Ethereum. Throughout 2019 there has been numerous experiments within the Ethereum ecosystem such as no lose lotteries (e.g. Pool Together) and CDPs (Collateralized Debt Position). That infrastructure can be applied to data. As soon as these proof of concepts are up and running with real money you can port that knowledge straight into intellectual property. With that data being financialised you can put insurance on top of it. You can put bonds on top of it to start financing it and getting it off their balance sheet.

Financialization – pricing data and develop financial tools around it

In 1982 Michael Jackson released the album “Thriller” from which he made close to a billion dollars. He talked to Paul McCartney about what to do with his money and Paul advised him to buy the classics and get royalty from them.

In 1985, the king of pop, Michael Jackson bought the Beatles Music Collection of 251 songs for $47.5m once McCartney and Yoko Ono declined to buy the rights. Today, that collection is worth well over $2 Billion. That’s essentially data that has been collateralized because every time a Beatles song is played the estate of Michael Jackson gets some revenue out of it.

Those songs can be bundled together to form a catalogue and sold off as a package. In the future, the package could be recomposed — with new songs or entire albums added, or songs and albums spun out separately into other catalogues.

In some areas, such as music, the intellectual property can be bundled up as rights and sold off. They can also be used as assets to back a bond security, with the royalties and rights used to guarantee the payment.

Data is intellectual property that is waiting for the pricing, trust and process to be simplified enough so that it can start to be traded. Once it can be traded, the tools of the financial system can be applied to create novel financial assets based on the revenue streams generated.

Infrastructure – Ethereum

Bruce uses the example of a hotel, where you’re checking into a hotel for a family reunion and you’re the one who has booked the entire suite of rooms on a whole floor. You have that access privilege for that entire floor which no one else can use. On Ethereum that would be an ERC721, a non fungible token.

As your family is coming to that floor you need to give them access cards to each room. As you have the primary right for the entire floor you can create three key cards per room which you can distribute to your family. On Ethereum that is known as an ERC20 which is a standard for a fungible token which can be freely exchanged. For example, your aunt wants to go back home she can give it freely to another family member.

As the manager of this family reunion you can create an ERC998 which is a composable token that gives you the right to whole floor and to each room. It effectively bundles the ERC721 and the ERC20. ERC721 which is like intellectual property, ERC20 which is 10 different key cards for the rooms and ERC998 which is a bundle of that you have three standards, built on the new financial infrastructure, Ethereum, you can model any type of financialization of intellectual property.

You can take someone’s music rights and wrap it in an ERC721. You can say these 10 organisations are able to use it at any moment in time and are able to sell that access right with ERC20 tokens. And then what people can start doing is they can start bundling access privileges, plus the actual rights to intellectual property together and start creating bonds, collateralized debt, collateralized, loans, and other financial instruments.

Protocol to implement access control on top of data

Bruce recognises that this is the hardest part, which is something that Ocean Protocol is trying to solve.

They are trying to make it so that anybody can publish their data for sale using decentralised infrastructure like for instance, InterPlanetary File System (IPFS), which scales globally. You need a way for people to define how they want to share their data and who can access that data. For example if you have health data you should be in control of who you want to give access to it. The ability to define and specify who you would want to share your data with is a fundamental piece. And in Ocean Protocol, this fundamental piece is called the service execution agreement. They’re also known simply Service Level Agreements for the data and rights to access the data, except machine readable.

So for example for sharing your health data you can say I want my data to be shared in this manner for this amount of money or for free if it’s for charity, or for research purpose. And then on top of that you have access control which is user rights on the type of access they get once it is shared with them. The Ocean Protocol service execution agreement manifests the users’ wishes into access control over their data.