George Alayon – Assistant Director in Insurance Supervision at the Bermuda Monetary Authority (BMA). George leads a small team whose responsibility is for pushing the insurance agenda of the authority. They oversee the insurance regulatory sandbox and Innovation Hub as well as the supervision of innovative insurers here in Bermuda. In this podcast we discuss the influential role the BMA plays in fostering innovation in the insurance industry.

What is blockchain?

Blockchain is a digital ledger where information can be stored, duplicated, and distributed across a network of computers whilst being cryptographically protected. For George, it is the opposite of the traditional way of storing information in a centralised manner where there is no single point of failure. This traditional process also may or may not result in the production of digital assets.

Introduction to the Bermuda Monetary Authority (BMA)

The BMA is the sole regulator of insurance companies, banks, trust companies, investments, the Bermuda Stock Exchange and credit unions. Recently they were given the mandate to regulate digital assets.

Locally they issue the Bermuda currency which is pegged to the US dollar.

As the sole financial services regulator on the island, they pride themselves to being responsible for maintaining Bermuda’s reputation as a top jurisdiction of choice especially for insurance and reinsurance.

Bermuda is one of a few jurisdictions in the world that have gained full solvency to equivalence from the EU, as well as having obtained both qualified and reciprocal jurisdiction status from the US NAIC.

In 2018, Bermuda was one of the first countries in the world to offer a comprehensive regulatory framework for digital asset businesses.

Evolution of insurance and digital assets

BMA defines digital assets to be anything that exists in binary format, and comes with the right to use it and includes a digital representation of value.

In George’s view, blockchain technology is a gateway to revolutionise the financial sector. Blockchain technology allows for the seamless exchange of information related to the basic elements of a contract including the consideration. In the case of insurance, consideration includes the premium paid by the insured in exchange for payment of claims in case of a loss event.

Historically the insurance industry has been heavily reliant on manual processes. The arrival of blockchain technology has given rise to a thriving digital asset business sector, which has forced the insurance industry and the rest of the financial services sector to rethink the way they operate and the future role they will play in this ecosystem.

Over the next two to three years, George sees a lot more market acceptance with the integration of digital assets, as a medium of exchange for insurance policies, as well as a utility pass or access to DLT based ecosystems.

Regulators role

The insurance industry is inherently risk averse.

One of the regulators biggest concerns is whether these technological breakthroughs have policyholder protection has as top of mind? Do they disclose enough information for parties to make an informed decision? How are companies thinking and preparing for the worst case scenarios? How do they intend to protect the data of their customers? Who is responsible for what in this decentralised network? How is the usual risk management process being replaced with this new process? At the end of the day all these questions are here to answer the question about how the interest of the policyholders will be protected?

George recognises that regulators need to think outside of the box and try to understand the technologies themselves.

In addition to performing their legislative mandate, policyholder protection, they can take a more active role in encouraging innovation. For example, by utilising technology to improve their own internal operations, as well as becoming enablers of these changes that can help to reduce the protection gap and making insurance more readily available to more people.

How does the BMA facilitate innovation in the insurance industry?

Early on the BMA’s key initiatives was to establish a regime for their Regulatory Sandbox and Innovation Hub. Effectively they were making a statement to the market that they are here, they want to learn and be part of this innovation journey along with innovators. This has allowed them to establish a closer dialogue with market innovators by giving them appropriate regulatory guidance.

New insurance classes

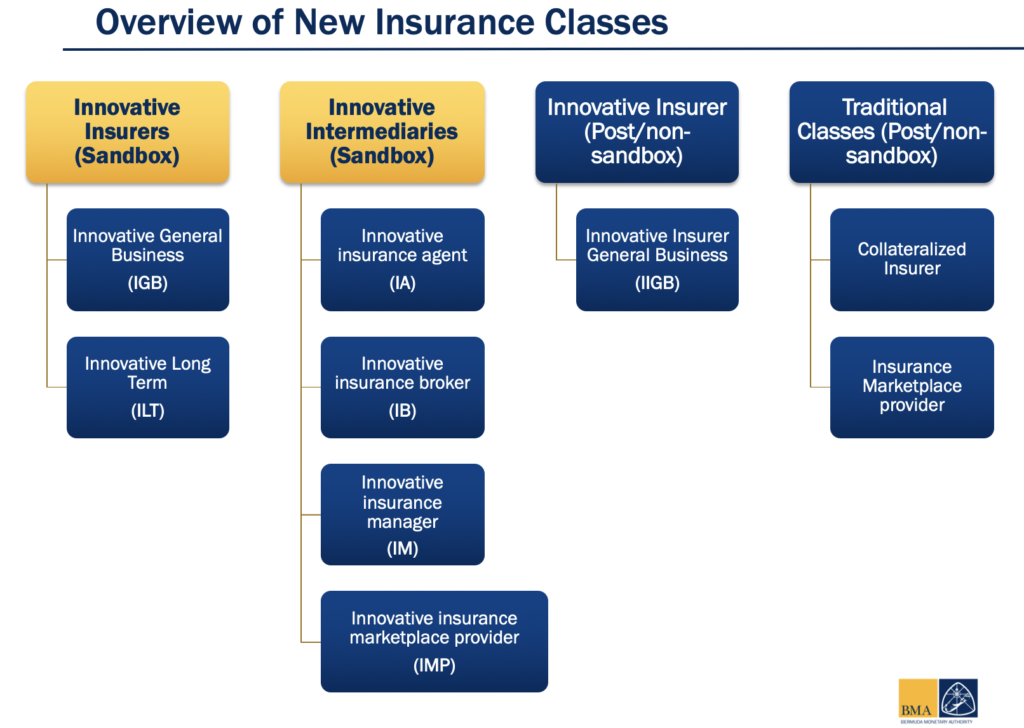

In 2018, the BMA started introducing new insurance classes for the sandbox, which is a licensing regime. Such classes include:

- Innovative Insurance General Business (IIGB): this class allows for insurers who want to adopt innovative models, such as those that want to have full cryptobased or digital asset-based business models. For example, it’s for companies who wish to collect premiums and make claims in crypto.

- Insurance marketplace provider: a new insurance intermediary class for platform operators that facilitate the trade of insurance risk.

- Collateralized insurer class: a class similar to their special purpose insurers, but caters to more complex business risks more flexible types of collateral.

Regulatory Sandbox and Innovation Hub

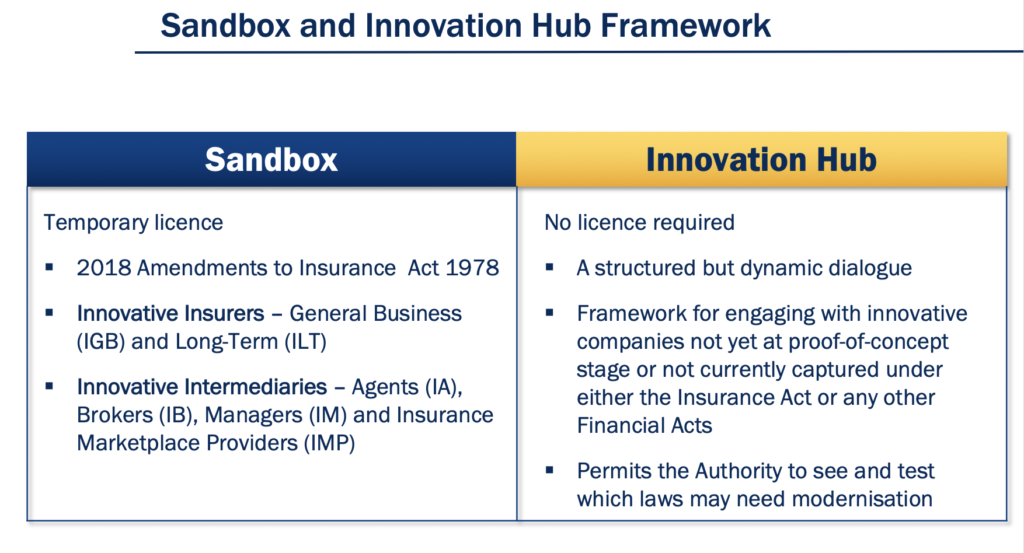

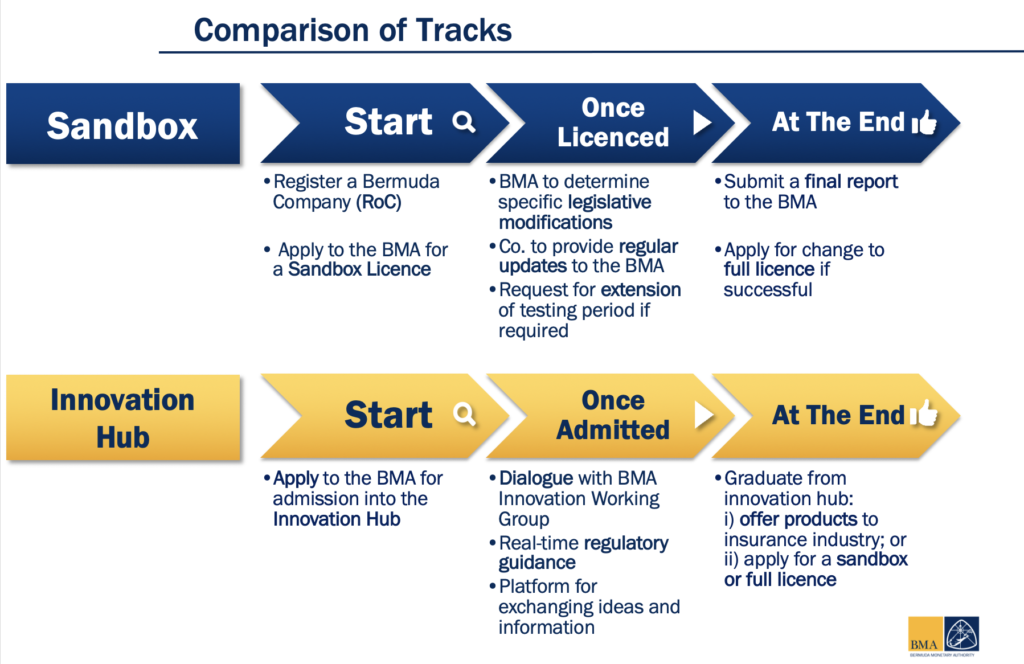

The Regulatory Sandbox is a licensing regime for insurance companies who wish to do licensable activities as defined under the insurance act. The Innovation Hub is similar to the sandbox but is only applicable for companies that are either not currently captured under either the insurance act or any other financial act that BMA regulates, or those companies that are licensable, but are not yet ready for live testing; companies that are still developing their proof of concept for example.

To ensure they remain relevant in the future, the BMA’s Regulatory Sandbox and Innovation Hub empowers them to cover both licensable and non-licensable activities.

The sandbox licence is limited for a specific duration of time, for companies to test their products. The sandbox would limit the target market that they can interact with, limit the specific risk or line of business that they are allowed to write, and limit the amount of exposure or risk that they are taking on.

Learnings from the Regulatory Sandbox and Innovation Hub

Since the establishment of the Regulatory Sandbox and the Innovation Hub in 2018 a number of proposed business models have been reviewed. One company that is currently in the Regulatory Sandbox seeks to create an electronic platform to trade insurance risk. Because of such type of innovation, the BMA went ahead and created the new insurance marketplace provider class.

Another entity that has gone through the sandbox offers a B2B placement process to claims management for reinsurance using a permissioned blockchain system. A third entity is using a digital first approach for operation by utilising digitals assets to both admit participants onto their network and as a medium of exchange for their insurance policy.

The BMA has had a number of learnings from those two initiatives. As a regulator the BMA learned a lot from the wide range of interactions with innovative companies. Due to the resource requirements, research and ongoing discussions, George was tasked to build a small team dedicated to focus on such interactions.

Another learning is that innovation can come from many different angles. Innovation can come from the technology side but also can be driven from the capital and capacity providers themselves.

George also believes that the regulatory landscape must be able to move with the time, if it wishes to remain relevant over the next decade. Uncertainty and changes will never disappear. Regulators’ frameworks will have to evolve from a tick box exercise and general standards check to a more customised, fit for purpose, technology driven, data driven and most of all a dynamic supervisory approach.

Companies the Regulatory Sandbox and Innovation Hub wishes to attract

Bermuda has a mature reinsurance market that deals with wholesale excess surplus and complex type of risk, that has always been the niche kind of market that they have cultivated over decades. With successful equivalence in both the EU and the US the BMA has established its credibility as a regulator amongst its peers.

The Regulatory Sandbox and Innovation Hub hopes to attract a good mix of innovative companies that will both: (1) solve current and specific pain points that the Bermuda insurance market and the overall insurance industry is dealing with and (2) those that will help prepare the island and the financial service sector to maintain its position as the risk capital of the world, particularly in addressing protection gaps in evolving risk areas, such as in digital asset covers, where it’s not readily available yet from traditional carriers.

However, George wants to point out that outside of those two points they still wish to attract businesses with quality projects that are owned and managed by quality and credible management teams and shareholders. Bermuda should be considered as a place to test out innovative ideas and for them to flourish.

They can apply by visiting the BMA website: https://www.bma.bm/insurance-innovation

Legislative enhancements the BMA has put into place to support the insurance industry

The BMA is presently doing a comprehensive review of all the financial sectors that they regulate. They are aware of the breakthroughs that are occurring in the market and they want to make sure they take a holistic approach to regulate these businesses.

For example, in response to the evolving risk that comes with full digitization of systems the BMA has put an emphasis on cyber risk management. In 2019 they introduced the Insurance Sector Operational Cyber Risk Management – Code of Conduct.

They are enhancing their AML/ATF Framework to ensure that that all their experimentation through the Regulatory Sandbox and Innovation Hub that they remain compliant or even above the international standards in financial crime prevention.

They have also introduced the Incorporated Segregated Accounts Companies Act, which is an upgrade of their traditional cell or segregated accounts structures. What this entails is that companies that have cell structures can ensure that each of the cells have their own separate legal entity within the same umbrella.

Plans for the next 12 months

They are an active member of the Global Financial Innovation Network who has recently launched its first cross border trial for companies. What this means is that companies will be able to test out their proof of concept across multiple jurisdictions at the same time.

The BMA will continue to enhance its framework by extending its sandbox regime to the rest of the financial sector.

The BMA will also be taking over the Digital Asset Issuance Act, which is equivalent to what is known as ICOs or initial coin offering to offer a regulatory framework to companies wanting to use digital assets in raising funds for their projects.