Central bank digital currencies (CBDCs) are increasingly being talked about in the press with announcements of initiatives from different central banks working on CBDCs coming out left right and centre. Few however are as forward thinking and embracing a collaborative approach as the Bank for International Settlements (BIS). For this podcast we are joined by Daniel Eidan, Adviser and Solution Architect at the Bank for International Settlements (BIS) in the Innovation Hub where he builds technology solutions for the central banking community with a special focus on blockchain and CBDC. He will share with us some of the exciting work his team are doing for driving CBDC forward.

What is blockchain?

Blockchain and DLT is often referred to as Web 3.0 whilst the internet of today is Web 2.0.

Web 2.0 enables to globally connect communications protocol whilst blockchain and Web 3.0 isn’t just about putting communication protocols digitally but to store value digitally. What blockchain enables is to execute computations between different members and keep a record of state. Essentially as Daniel mentions we can encapsulate value. Value can be cryptocurrencies, central bank digital currencies, contracts and many other forms of value. This wasn’t something possible in the Web 2.0 because the fundamentals weren’t there.

What are CBDCs?

To fully understand what CBDCs, central bank digital currency, are you first need to understand what is a currency. Money and currency in general have three attributes:

- They are a unit of account

- A store of value

- A medium of exchange

What central bank digital currencies do is that they digitise those three attributes.

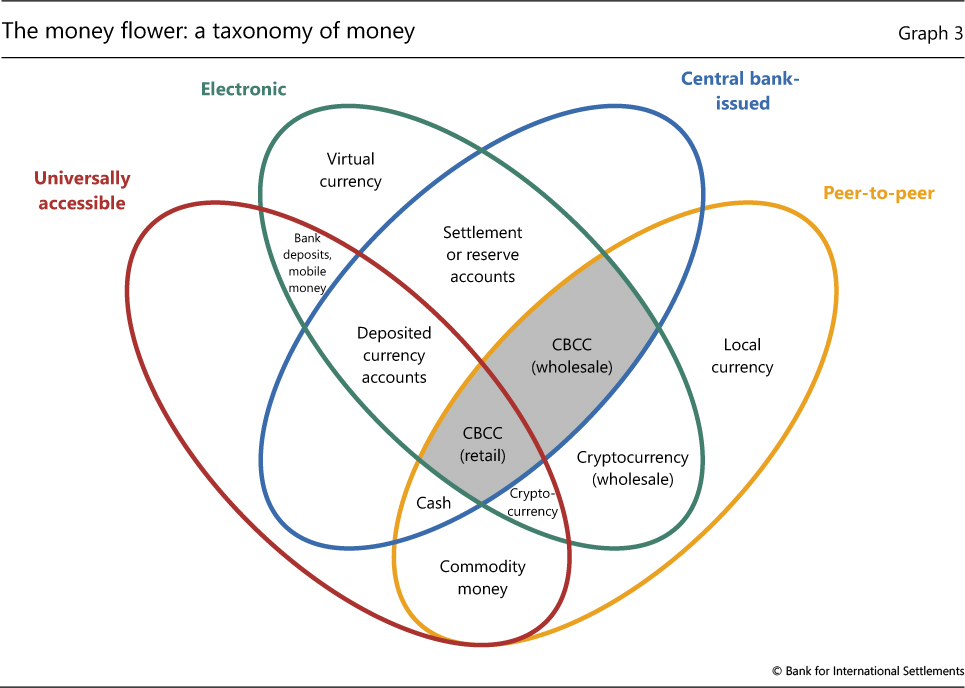

To explain how this happens Daniel uses the “money flower” approach which looks at its four different attributes:

- Is it universally accessible?

- Is it electronic?

- Is it issued by a central bank?

- Is it moved around in a peer to peer way?

A retail form of CBDC will have all four of the money flower attributes. It will be universally accessible, it will be electronic, it will be issued by a central bank and contain central bank liability, and it will transact in a peer to peer way.

What is important to recognise is that most of the retail monetary base is not central bank money, it’s commercial bank money. For example, when you deposit money at you bank it is likely that a large part of your fiat currency is with a claim against your commercial bank. Then through a set of mechanisms that claim is insured by potentially a central bank or a federal institution.

The only claim that retail can have against a central bank is in the form of cash. Cash of course is a tiny percentage of the total amount of money individuals have. What CBDC does is takes that cash liability, in a retail context, to exist in a digital context in a way that’s accessible to anyone.

The question is what happens to individuals who do not have a smart device, or electricity, or WIFI? In addition, how is universal accessibility attained to individuals with disability issues or are elderly? There are a number of technical solutions that can help to lower this barrier but it is one that is a challenge in terms of the last mile for reaching ubiquitous CBDC.

In the case of wholesale, the case for CBDCs is to broaden the base of digital currency from tier one institutions that are regulated domestically to fintechs, startups and perhaps banks in other jurisdictions. So, it’s really extending the promise and the capability of central bank money.

Privacy

Why is cash private? There isn’t actually a mandate for money to be private. The fact that cash is private is a consequence of the technology. Cash however isn’t always private. For example, purchasing a house in only cash cannot be done in a private privacy manner.

Daniel makes the important point that CBDC will promote more privacy than digital payments of today that are motivated by commercial interests. Daniel then asks “would you be more comfortable just in terms of that privacy aspect to pay with your Visa card, knowing that visa has your data and visa can do whatever they want with your data, as long as it falls within they’re licence as a payment provider versus, something that’s issued by a central bank that the central bank has no other objective other than what’s best for the social good.”

Bank for International Settlements (BIS)

The Bank for International Settlements (BIS)’s mission is to support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks. As individual’s lives are increasingly becoming more digital and it is increasingly apparent that any central bank whose aim it so provide financial stability has to invest in the digital space. In 2019 the BIS launched the Innovation Hub Network, to support the Innovation Hub priorities, share knowledge about technology projects and discuss innovative answers to problem statements relevant to central banks.

The Innovation Hub Network is a joint partnership between the BIS and regional central banks to open innovation hubs that service the central banks their surrounding regions. The first three were in Switzerland, Hong Kong and Singapore. Now there are new hubs in London, Stockholm, Toronto and a strategic partnership has been set up with the New York Fed. They’re also planning to open hubs in Frankfurt and in Paris amongst many others.

These hubs are going to engage the private sector to bring technical talent and know how to inform policy markets and the central banking community.

CBDC is one of the six verticals that the Innovation Hub Network is working on: supervisory and regulatory technology, next generation financial market infrastructures, open finance, cybersecurity protocols and on green finance.

Project Inthanon-LionRock to mBridge

In May 2019 the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BOT) launched Project Inthanon-LionRock a first common platform for multiple CBDC settlement. Phase 1 of this project achieved a PoC built on R3’s Corda designed to allow the participants of each network to conduct fund transfers and foreign exchange transactions on a peer-to-peer basis, thus reducing settlement layers.

Phase 2 of this project was built by ConsenSys on Hyperledger Besu to extend Phase 1 to two other jurisdictions being the Digital Currency Institute (DCI) of the People’s Bank of China (PBC) and the Central Bank of the United Arab Emirates (CBUAE). The participating central banks are able to control the flow of their CBDC on the prototype, monitor transactions and balances of their issued CBDC, utilise programmable levels of transaction privacy, and automate certain compliance functions.

The project then evolved to Phase 3 called mCBDC Bridge, “m” for multiople, or in short mBridge. As the name implies the platform is built to facilitate multiple different central digital currencies to perform cross border payments in a cheaper, faster and more efficient manner.

Today is obvious that there is no public sector organisation that has the mandate to facilitate cross border payments. It is all provided by private institutions who are commercially driven. The amount charged will depend on locations, currency pairs and the amount of money being sent. Currency pairs for example that do not have a lot liquidity may have to go through a third currency pair to facilitate the transaction leading the user to have to pay 2 FX rates. This contributes to the reason on why remittances can cost 6.5% of fees on the transaction.

With mBridge there is the opportunity to provide a faster, better and cheaper way settling payments in central bank money. Transactions for example have moved from a few days to within two seconds!

mBridge looks to drive the use case around international trade settlements to facilitate international trade between those jurisdictions and also to open up the platform to additional central banks and also to private sector players.

Inthanon-LionRock to mBridge

Electronic Hong Kong Dollar (e-HKD)

e-HKD is a joint partnership between The Hong Kong Monetary Authority (HKMA) and the BIS Innovation Hub is an attempt at exploring retail CBDC. Retail CBDC is very much about the last mile solutions. It’s about the privacy, offline, how the retail space interplays with the wholesale space and how this doesn’t influence the role of commercial banks in the economy.

In September a whitepaper was published entitled “e-HKD a technical perspective” that explores potential architectures and design options that could be applied to the construction of the infrastructure for distributing e-HKD, and reports the initial thoughts and findings. Specifically, it aims to explore technology solutions that address the problems of cross-ledger synchronisation, over-issuance prevention, privacy-preserving transaction traceability, and flexible instantiations of different two-tier distributions models.

e-HKD_A_technical_perspectiveThe paper displays the focal point on how money moves between two interoperable systems, one being the wholesale monetary base and the second a retail monetary base with a special focus on privacy.

7 Central Banks exploring retail CBDCs

Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, Sveriges Riksbank, Swiss National Bank and BIS have joined forces to explore what a retail CBDC might look like.

BIS - CBDCIn their 1st report, the banks got together to create some baselines for the thinking around retail CBDC. In September 2021 a new report was published that had three categories:

- systems design and interoperability. As central banks operate within a domestic agenda, the piece of interoperability is critical to ensure that they can connect to each other

- user needs and adoption

- financial stability implications

_______________________________________________________________________________________________________

This episode is brought to you by our friends and sponsors at R3. In this digital-first world, now more than ever, businesses need to modernize existing processes, systems and models – and enterprise blockchain provides the ideal solution for transacting directly and streamlining business operation.

Developed by R3, Corda is light years ahead of other blockchain platforms in terms of privacy, security, scalability and interoperability. And–because Corda was built to meet the stringent requirements of highly-regulated industries, it can be used by firms of any type or size and in any industry.

Blockchain applications built on Corda can reimagine and increase the potential of existing business networks, enabling direct and trusted transactions that eliminate friction and accelerate growth.

Check out r3.com to find out more.