Welcome to another episode in ours News Flash series, where we share the latest developments in the blockchain space, straight off the press. Today we are joined again by David Edwards, CEO of ChainThat, who previously featured in Ep.8 – Building a Blockchain PoC/Pilot, and we welcome Rebecca Oliver, business development director at ChainThat, to Insureblocks for the first time.

About ChainThat

David Edwards formed ChaintThat in 2015 with the sole focus to see how blockchain distributed ledger technology can impact commercial speciality insurance and reinsurance. Since there early start ChainThat cover the entire value chain from the placement process to technical and financial accounting, settlement, claims administration and facilities, tax and regulatory reporting. ChainThat has received investment from Xceedance and has now grown to about 30 staff.

Launching the world’s first technology-driven insurance and reinsurance risk and capital exchange

ChainThat’s new initiative is to launch in Bermuda the most efficient reinsurance risk and capital exchange in the world called the Bermuda Risk Exchange.

Why Bermuda? Bermuda, is home to the ILS and a lot of captives, it has a very proactive government that wants to drive innovation in Fintech and Insurtech. The regulars are one of the leaders with their digital asset regulations and the tokenization of assets. Bermuda has a great community spirit that is keen to innovate and bring a blockchain based solution of the ground.

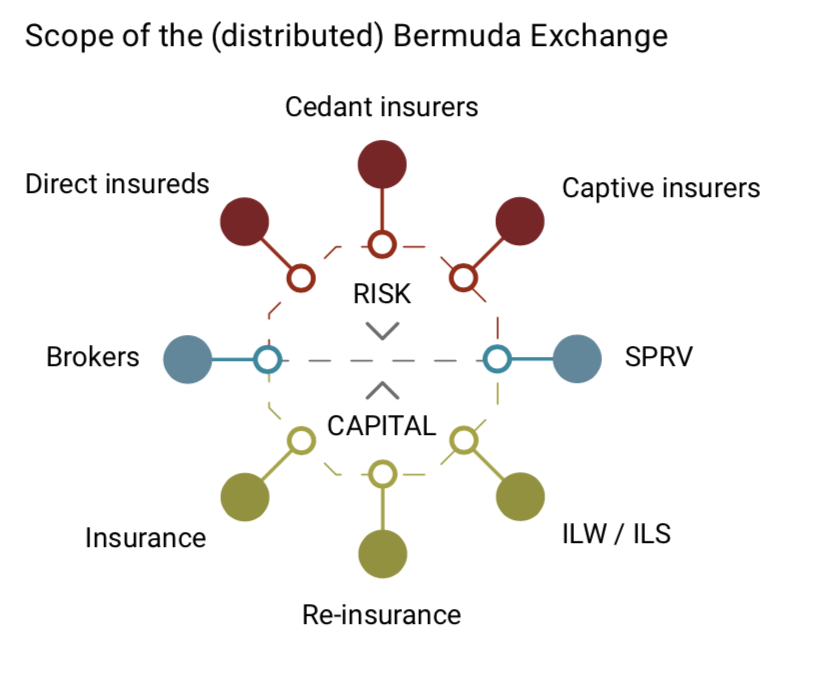

Scope of the Bermuda Exchange – Source: ChainThat

From a marketplace platform to a risk exchange

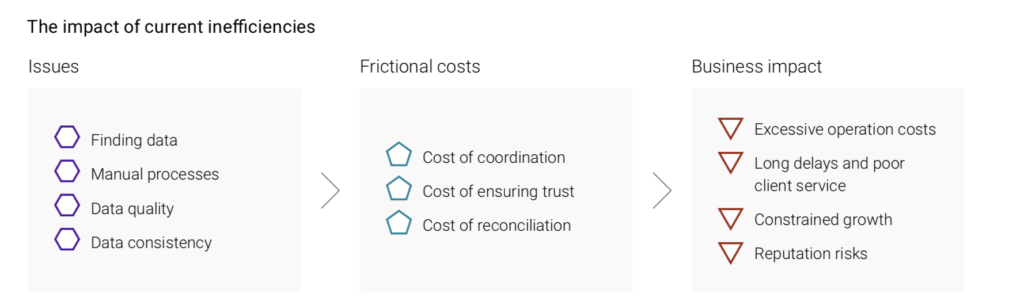

ChainThat is offering a marketplace platform that will morph into a risk exchange. Initially the platform will be supporting existing back-office processes such as the placement of risk to supporting the technical and financial account and then moving into the settlement process and claim’s agreement process. The aim is to remove frictional costs to drive down costs to make insurance more efficient that it is today. The platform is built on Corda and uses the ACORD data model for all transactions.

Impact of current inefficiencies – Source: ChainThat

David hopes to offer this risk exchange to other insurance marketplaces by finding one regulatory area that has high trading volumes and lots of participants such as Singapore, Dubai, Zurich and New York.

Why blockchain?

The challenge centralised systems have to running a marketplace for insurance companies is that the centralised entity has to store the data and manage the system on behalf of the marketplace participants. However, the insurance business model is a peer-to-peer one, just like they used to in the Lloyd’s coffee shop. That’s what blockchain technology enables, it gives participants back the control of their data and their process. It provides the guarantee that you’re looking at the same version at the exact same point of time.

Education & Customer Centricity

At the beginning David concedes that there was a lot of misinformation about blockchain and distributed ledger technologies. So they had to spend a considerable of time educating all the main parties (brokers, reinsures and regulators) and engage with them on a one-to-one basis. This meant that ChainThat had a customer centric approach to defining the exchange and ensured that the participants within the exchange helped to shape and finalise the final outcome.

Brokers and disintermediation?

David believes that individuals who believe that brokers will be disintermediated by blockchain lack the understanding of what the broker really does. For David the brokers are the market makers, they provide the risk management services to the customers and they provide back office services. It’s the back-office services that blockchain is looking to streamline. Not just for the brokers but for all insurance entities. By improving efficiencies in back-office services then brokers can deploy their resources more effectively at making those markets and providing better value to their customers around their risk management services.

Products on the risk exchange

Initially the exchange will start off with property, and facultative and treaty contracts. Looking at doing the accounting, settling and claims related to those. ChainThat will be adding further lines of business onto that and alternative risk transfer, ILS and ILW.

Top tips for aspiring marketplace

So, the first thing is don’t be afraid to fail. You’ve got to fail fast on these things and you know try it as quickly as you can. Try things quickly, if they don’t work try something else quickly.

David’s top tip is don’t be afraid to fail fast and to keep trying out new things. Take an iterative approach from starting on a small project that take can be started on a credit card and then rapidly scaled up.

The big bad word of “integration”

ChainThat has thought about integration from day one. In a marketplace the market moves as slow as the slowest participant which usually is around integration. ChainThat has built a layer on top of its platform that acts as an accelerator for integration which can also integrate with ACORD messaging. ChainThat has data pipelines for performing data mapping exercises which enables them to talk to their firm’s internal systems.

What does success look like?

After the launch event of the 5thof March, ChainThat is going to be looking for participants to sign up to the live production trail to use the platform. During the duration of the trail there will be key milestones to define the efficiencies and demonstrate the KPIs against the trail. They want to be able to see how the participants will be able to sell the trial internally to their boards to demonstrate the true value from concept to live production and to demonstrate the potential of what this platform can provide and the new products they could thing to bringing to the market.

From a ChainThat perspective they want to see that they have defined an exchange that has the longevity to go into live production with multiple participants in Bermuda.

Your turn!

ChainThat has launched a truly innovative and modern risk and capital exchange in the market. We are very excited to have been given the chance to report on this exciting news.

We hope you have enjoyed this news flash, if you liked this episode please do review it on iTunes. Your comments and suggestions are always appreciated so please don’t hesitate to add a comment below.

If your organisation has any news you’d like to share regarding blockchain, feel free to get in touch with us and we’ll help you spread the word. If you’d like to ask David and Rebecca a question, you can add a comment below and we’ll try to get them over to our site to answer your questions.