Insurwave – A Maersk pilot for marine blockchain insurance

Too often in the insurance industry we entertain in navel gazing by looking at what we do and what our competitors do, instead of really focusing on who keeps our lights on… our customers. So, for this week’s podcast we look at a customer’s perspective of marine insurance by talking to Lars Henneberg, Head of Risk Management at the logistic and transportation giant Maersk.

Maersk is the pilot customer of a new marine blockchain insurance platform called Insurwave that was launched by EY, Guardtime, Microsoft, Willis Tower Watson, XL Catlin, MS Amlin and ACORD.

As a special treat I was joined by Marilyn Blattner-Hoyle, Head of Supply Chain and Trade Finance at AIG as my co-host.

2 minute definition of blockchain

For Lars, blockchain is a technology to share real time data. It gives perfect visibility to the participants. It can conduct a number of transactions simultaneously across a multiparty value chain.

What is marine insurance and how does it work?

Shipping has always been in the business of taking risks. As Lars says, “in shipping we like risks we just don’t like the burden of them which is why we come to insurers”. There are four type of risks that require marine insurance:

- hull and machinery of the vessel itself,

- container boxes,

- the cargo that is inside the container and

- all the liabilities that you can incur as a ship owner (Eg. pollution, damage to the cargo, or injures to the crew)

The marine insurance value chain and its challenges

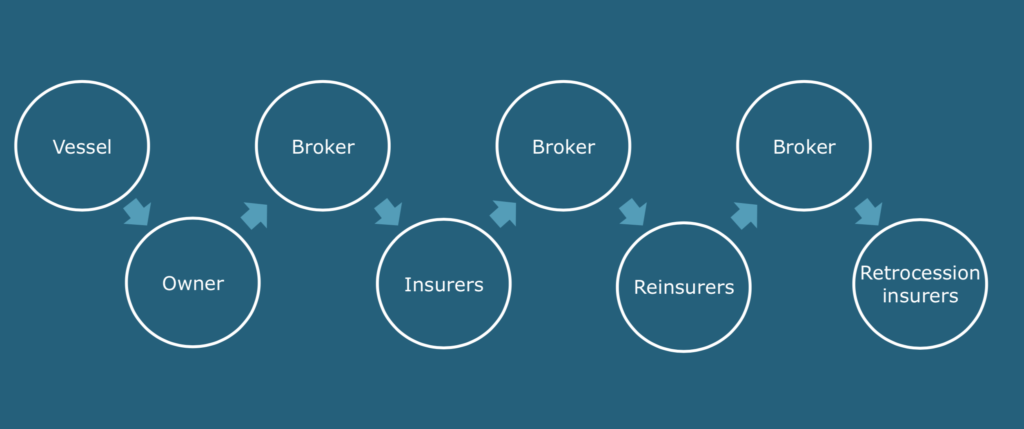

The way that risk is transferred to the insurance market is very long and cumbersome. The distance between risk and capital is simply too long. You’re left with a very long value chain with too many intermediaries, that is very manual:

- A ship owner goes to a broker

- The broker goes to an insurer

- The insurer takes the risk and goes to another broker

- The broker finds a re-insurer who takes part of the risk

- The re-insurer goes to another broker to find a retrocession insurer

This value chain is very sequential and linear in how business operates with many frictional costs involved in it. As an example, for Maersk to insure one of its vessels it would typically take 100 document transactions and involve about 50 different stakeholders across the value chain.

There is a lack of transparency in such a value chain because a lot of information gets lost. Significant value leaks because all the intermediaries in the value chain take a portion of the premium as it goes through the value chain. For example up to 40% of the premium is transactional costs. This creates a level of dissatisfaction amongst insurers’ customers as the system is antiquated, it is costly and inefficient.

Challenges within the marine industry

The lack of data is a big issue to the marine industry. No one has a holistic view of the risk because insurers have chopped up the risk in fragmented lines of business. Some insure the ports, some insure the vessels, some insure the finance but no one has a holistic view. At the same time there is no real time visibility to the participants in the value chain.

Overall it is a very fragmented, reactive and slow industry which needs to be more forward looking.

This present system ties up too many resources for the customers of marine insurance. It ties up to 75% of their time on insurance contract administration and 25% on risk management. It should be the other way around.

Lars recognises that there has been some initiatives in the insurance industry to make the business model more efficient. Some of these initiatives have looked to get more shared real time visibility of the risk, which means that instead of using static demographic data you can follow the risk in real time such as where are the vessels, where do they trade and at what ports do they call. Additional initiatives have been towards automating underwriting through blockchain smart contracts. The administrative area can be automated by removing some of the manual processes from collection of information, policy distribution and invoicing some of the payments.

Maersk joins the Insurwave initiative

On the 25th of May, Maersk, alongside your partners: EY, Guardtime, Microsoft, Willis Towers Watson, XL Catlin, MS Amlin and ACORD, all announced the launch of Insurwave, the world’s first blockchain solution for marine insurance.

You can watch a short video on Insurwave below:

Maersk was approached by Ernst & Young (EY) who invited Maersk to become the pilot customer on a proof of concept (PoC) to use blockchain to remove the inefficiencies the industry has experienced. The intention of this PoC was to build an operational solution around the Maersk value chain around marine hull insurance. A PoC was launched to see if it was possible to automate and/or eliminate some of the manual processes. If blockchain was the right solution to do that? Whether it was possible to innovate the insurance industry and finally to dig into the concept of smart contracts if they would work in an insurance concept? The PoC was completed by July of last year with an affirmative conclusion to the above questions.

Since then Maersk and their partners have been working hard in operationalising the solution to launch in April 2018.

The production ready solution can be scaled up across marine insurance but also into other industries such as aviation, energy and others. This is about speciality insurance for clients who require speciality insurance.

The Insurwave blockchain platform

Insurwave is built on a Corda blockchain platform where data sharing is at its heart. It operates on distributed ledgers which are used to manage identify of the participants on the platform (their authority on the platforms and perform the necessary regulatory checks). Another distributed ledger is used to manage the exposure data where all the data points of the vessels are kept. In the past they used to store up to 7 data points per vessel now with Insurwave they can manage up to 27 data points which would allow more sophisticated underwriting. An additional distributed ledger is used for smart contracts which when combined with exposure data it will transform it into a price of the risk and generate the required endorsements.

There will be a distributed ledger for declarations so when a vessel enters into a war zone there will be different premiums that will automatically apply.

Finally the corda blockchain platform is permissioned giving the participants the right level of permission for accessing data.

What opportunities is there for insurers?

If you consider that a lot of the components that are in a premium are cost components, that come from transaction costs, up to 40% of the premium is transactional costs. Blockchain provides insurers with the opportunity to cut some of that transactional costs and to be able to use the capital more accurately as they will have more data on the risk. This means that insurers won’t have to err on the side of caution.

It is a well known fact that in the insurance industry you always pay for uncertainty. However, the richer the data you can deliver, the more certainty you can give insurers about the risk and their ability to price the risk accurately. So, pricing isn’t based on standard models but on a real time picture of your particular risk.

Your Turn!

Lars shares many other interesting and fascinating points regarding the opportunity of blockchain in marine insurance. If you liked the podcast please do review it on iTunes. If you have any comments, suggestions on how we could make it better please don’t hesitate to add a comment below. If you’d like to ask a question to Lars feel free to add a comment below and will get him over to our site to answer your questions.

Big thanks to Marilyn for being a great co-host.

Thanks again Lars!

It is very inspiring to hear directly from #LarsHenneberg how seriously Maersk is taking blockchain technology. Lars, as Maersk has successfully concluded the PoC resulting in #Insurwave, would they be open to examining other use cases which leverages blockchain to significantly reduce backoffice inefficiencies when it comes to Claims handling and administration?