Insurwave, the new marine insurance blockchain platform launched by EY, Guardtime, Microsoft, Willis Tower Watson, XL Catlin, MS Amlin and ACORD and piloted by Maersk has been a recurring theme here at Insureblocks.

In a previous episode, Insurwave – a Maersk pilot for marine blockchain insurance, we examined the client’s perspective. In a more recent episode, Insurwave: the complete story with EY, we discussed the process of creating Insurwave. To complete the circle, today we will look at Insurwave from an insurer’s perspective.

For today’s episode we were lucky enough to have two speakers, Madeline Bailey, Head of Strategic Initiatives at MS Amlin, and Hélène Stanway, Digital Leader at XL Catlin.

Blockchain in two minutes

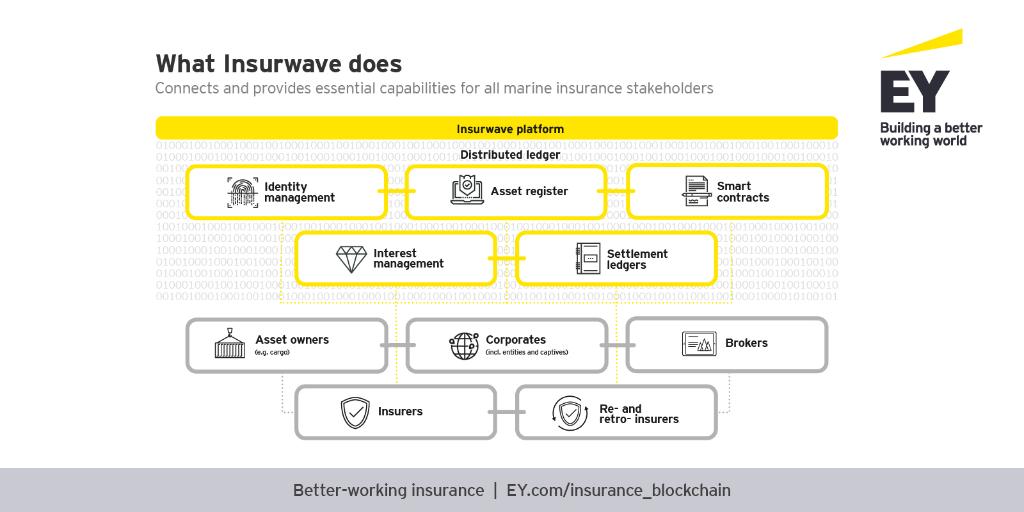

Blockchain is a distributed ledger that allows users to share data in real time in a secure and immutable way. This data can be related to assets, for example the location of a vessel, or it can be a smart contract, a piece of code set to execute when a set of specified parameters is fulfilled.

Blockchain has the potential to create trust between parties in the insurance industry and improve risk intelligence, lowering costs and benefiting parties across the insurance value chain.

Why Insurwave?

In the past four years the marine insurance industry has experienced declining performance and increasing combined operating ratios. It has become necessary, therefore, to take a strategic look at the industry and consider how new technologies can improve efficiency. In building Insurwave, both MS Amlin and XL Catlin were willing to take a leadership position in the insurance industry and commit to a vision of how the industry is going to develop.

In an industry not known for embracing change, developing Insurwave came with challenges. Working alongside competitors and completely re-inventing the underwriting process is not something insurance companies have done before. However, every participant was keen to grasp an opportunity to cooperate with representatives across the value chain and consider what each needs out of an insurance transaction to re-imagine the underwriting process.

The low margins plaguing the insurance industry posed an additional challenge. Unlike usual, well defined projects, it is harder to quantify the costs and benefits of investing in innovation. For that reason it was important to have a clear set of goals with Insurwave. One of the main factors Insurwave has been successful is its focus on providing hull and war cover for its pilot with Maersk.

Insurwave’s effect

Insurwave allows parties to seamlessly share data between them. By combining blockchain with IoT data, parties have access to real time information. At the moment Insurwave provides over thirty data points per vessel. The aim is to get to fifty. Insurers get more data, get data of different types and get it in real time.

Up until now, insurers traditionally looked backwards to quantify risk. This means the insurance industry has yet to come up with a definitive answer on how to use all this new data but Insurwave opens up a range of new possibilities.

1. Real time decision making

Real time data updates have the potential to shift traditional business models in favour of real time decision making. Consider war zones, for example, which are geofenced in a smart contract on the blockchain. A vessel captain will be able to decide between navigating through a war zone, knowing it will lead to an added premium, or avoid it in favour of a longer journey which will also require more fuel but at a lower premium.

Additionally, connecting the IoT data points to risk and contract data opens up the possibility for different types of products and services for clients, creating a better tailored and more efficient service.

2. Cost reduction

Another advantage of effortlessly sharing information is cost reduction. Traditionally, each party in the value chain has to scour through their own set of data, wasting time and resources often just to reconcile their data with that of another party. Insurwave provides a full audit trail for every transaction, ensuring every party accesses the same, accurate data.

This means that Insurwave also provides fundamentally embedded compliance as the blockchain includes regulatory data as well. Sanctions checks, money laundering checks, identity and trust checks will all be done at once and on the same platform, lowering costs significantly.

3. Effect on premiums

Combining blockchain integration with IoT devices leads to an abundance of data points which can be used to build more sophisticated, near real time risk models. Some underwriters, however, argue that existing marine insurance policies are already unsustainably low and the ability to utilise new data might actually raise premiums.

This is unlikely. At the moment, fifty cents in every dollar of premium cover costs and tackling this can increase profitability while keeping premiums low. Additionally, in the current model clients have to pay for uncertainty as insurers err on the side of caution when averaging and aggregating data and price using historical information. However, thanks to the additional data Insurwave provides, insurers will be able to quantify the risk with more certainty and provide personalised pricing that reflects a fair value for the client.

4. Capital requirements

With access to this new range of data, insurers will be able to better understand and measure risk. With that knowledge it is possible to convince regulators on lowering capital requirements under Solvency II.

Regulators seek assurance from insurers on how they manage and control risk. Having an immutable and easily accessible risk profile will therefore be a huge asset to regulators and help establish a relationship between data and risk, leading to lower capital requirements. While it is still early and the relationship between data, risk and capital will have to be better delineated first, this is a goal the team behind Insurwave is definitely considering.

Learnings and advice

Having been through the process of creating Insurwave, Hélène and Madeline are happy to share their advice on developing an insurance blockchain platform.

1. Listen to your ecosystem

Listening and truly understanding what participants across the whole value chain need is integral in launching a successful blockchain platform. By bringing together the client, the broker and the insurers it was possible for the team behind Insurwave to re-imagine how marine insurance worksand create a platform that benefits the whole industry.

2. Focus on the client

A lot of the value chain benefit starts from solving the client’s problem first. Working in a customer-focused environment is key in providing a clear outline of what a customer actually needs. Having Maersk in the Insurwave group contributed to the project’s success as it ensured Insurwave is designed with improving client service in mind.

This is particularly important because as new technologies are introduced, risks are no longer just physical. They are both physical and digital and new products and services must be designed in order to provide the right coverage, at the right price, using the right underlying data.

3. Get involved

The best way to learn about blockchain is to get involved and start your project. However, it is important to remember that building a new platform is not the only option. Existing platforms, like Insurwave or B3i, are designed to be open and can improve as their network expands. The more companies on a platform, the more data will be available to share between parties who wish to transact.

Your Turn!

Hélène and Madeline give us a fresh perspective on how blockchain and Insurwave can help insurers increase efficiency and profitability.

If you liked this episode please do review it on iTunes. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below. If you’d like to ask Hélène or Madeline a question, feel free to add a comment below and we’ll get them over to our site to answer your questions.

Big thanks to Madeline and Hélène!