Creating a decentralised insurance model with blockchain & smart contracts – Etherisc

This week we are taking a broader look on how blockchain can transform the insurance sector. Specifically, we will consider how blockchain and smart contracts can be used to create a decentralised insurance model.

With us we have Stephan Karpischek, co-founder of Etherisc. Etherisc is building decentralised insurance applications on the Ethereum blockchain. They began in 2016, pioneering a flight delay application utilising a public blockchain. Currently they are developing over 20 products and will soon release a product covering hurricane insurance for Puerto Rico.

Etherisc’s vision is much larger than simply developing its own applications. It is building an open and free protocol for decentralised insurance so that companies can develop their own insurance products using smart contracts.

Blockchain (and Ethereum) in two minutes

On a first level, a blockchain is a data structure. On a larger scale, blockchain is an experimental field where we can try and build new incentive schemes. It is an opportunity to re-evaluate how economic actors cooperate and make decisions. We can use blockchain to develop new financial instruments, and more generally a new financial system, that works better than the current financial industry and economic structure.

The Ethereum blockchain adds another infrastructure layer. At its core, Ethereum is meant to be an open space. Everyone can join the Ethereum network and develop their own applications and financial products. This means that Ethereum is supported by a large and diverse community of developers who make sure the blockchain rises up to any challenges it faces, such as cost of transactions. This makes Ethereum one of the most mature blockchains to tackle the decentralisation of the insurance industry.

The decentralised insurance model

1. The goal of decentralised insurance

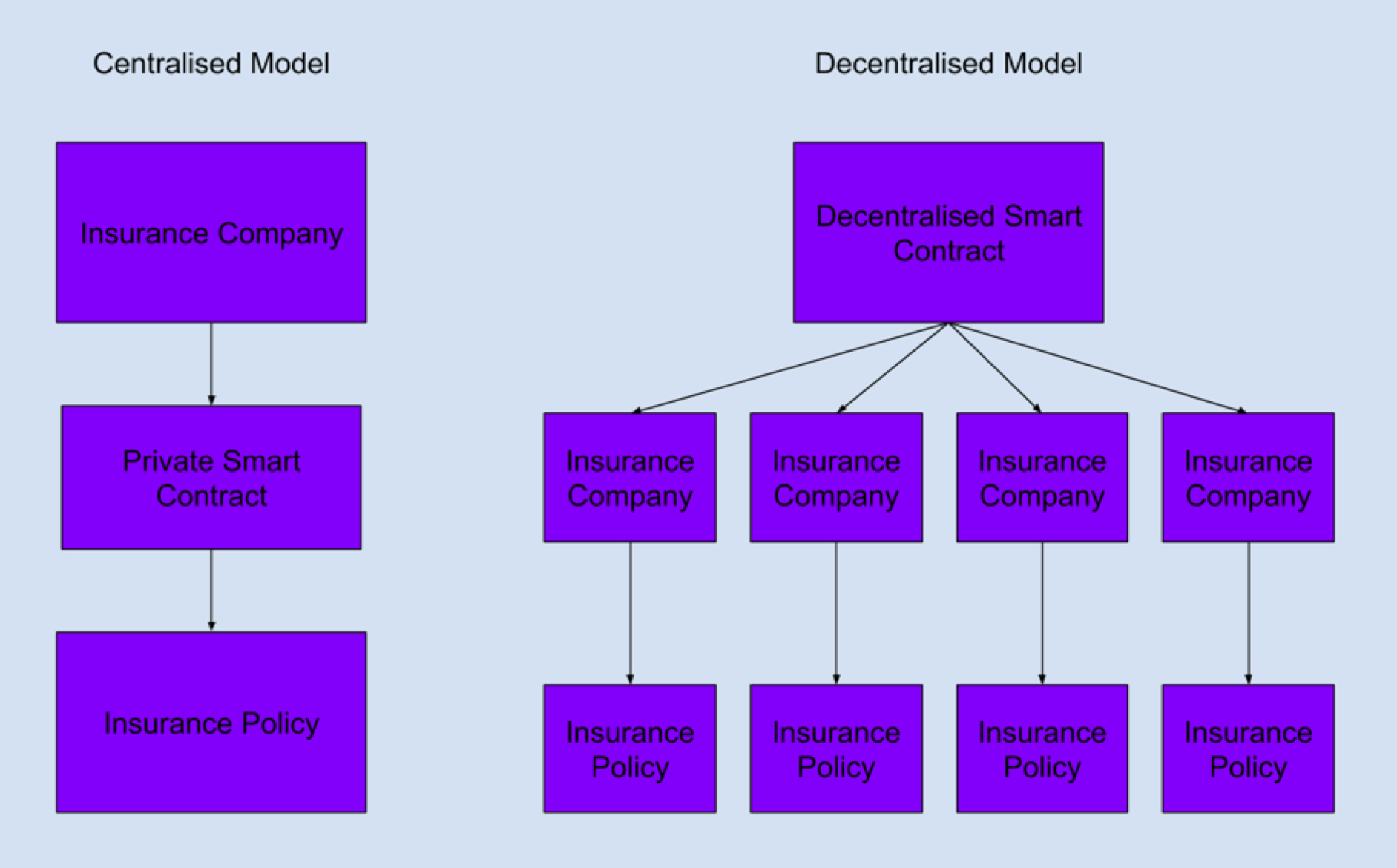

So why should we decentralise insurance in the first place? In the current insurance model there is an asymmetrical relationship between the insured and the insurer. The insurance company manages both the risk pool and the pay-out. They are therefore incentivised against paying out claims, at the expense of the insured.

A decentralised model using blockchain offers a solution to this problem. Blockchain can be used to build automated systems that manage the risk pool just like an insurance company, minus the commercial incentive to withhold pay-out.

2. Smart contracts as a public utility

A decentralised insurance model assumes that any company can provide their own insurance product. To achieve this, it is necessary to make the means of providing insurance easily accessible. Etherisc’s solution to that is a smart contract that is freely available to copy and use. Anyone would be able to use this technology without requiring a licence.

As often happens with free software, funding can be an issue. Etherisc is using a token sale to fund this idea and has already raised enough money for a few developers to start work on this protocol. In the end, however, making smart contracts a public utility is a community project requiring the feedback and engagement of the developer community. This makes the open Ethereum blockchain an ideal environment.

3. Traditional insurance actors in the decentralised model

Smart contracts can automatically examine a balance sheet, collect premiums and make pay-outs under certain conditions. This technology becoming freely available would mean that traditional insurance companies would have to fundamentally adapt their business model.

The first step to do that successfully is educating themselves. Stephan firmly believes that insurance companies need to use a decentralised system in order to understand it. His advice for insurance companies is to start using blockchain applications. It is important to look beyond private and consortium blockchains and consider the fully transparent option of a public blockchain.

The second step would be embracing change. This is more challenging. What often happens is that when insurance companies believe they have understood what blockchain is all about, they decide on starting their own experiments rather than consider Etherisc’s decentralised vision.

While traditional insurance companies are known to be risk-averse, regulators have proven to be a strong ally of Etherisc. Numerous regulators across different jurisdictions are interested in working with Etherisc and using the transparent nature of blockchain to protect customers worldwide.

4. Etherisc in the decentralised model

Etherisc aims to become an enabler. It wants to help others develop their own insurance products and incentivise them to work together on a wide range of applications. Currently, Etherisc is focused on parametric insurance. They provide a data source or an API that can act as an oracle. An oracle is essentially a third-party service that can push external data onto the blockchain, from where it is accessible by the smart contract.

Etherisc’s flight delay product offers a good example. The customer pays a small premium into a smart contract. The smart contract, which, through Etherisc’s oracle has access to the relevant data, gets informed about the flight being delayed and pays the customer in accordance with the insurance policy.

This paradigm can be applied to many different scenarios. Weather is another data source and Etherisc’s HurricaneGuard is a first instance of weather-based parametric insurance. Other areas include train delays and traffic jams. This model can also tackle more sophisticated forms of insurance, such property and casualty, life, health and social insurance. There is no area of insurance that cannot be improved in accordance with Etherisc’s vision.

5. Stable coins

Cryptocurrencies provide a lot of flexibility to the decentralised insurance model. One reason, however, people are reluctant to use cryptocurrencies in insurance is volatility. An insurance policy can last for years and the volatile nature of cryptocurrencies can diminish a customer’s returns. Resolving this issue would help Etherisc’s decentralised insurance model gain popularity.

A possible solution is using stable coins, which are tied to a fiat currency and therefore hold their value. The technology is still in early stages but Stephan believes it is possible and Etherisc is using a stable coin called Dai that is tied to the US dollar.

Etherisc and diversity

Etherisc has clearly set some ground-breaking goals but their visionary nature is not limited to commercial aspirations. From the beginning, Etherisc has had a strong commitment to gender diversity and nearly half of their core team are women.

Here at Insureblocks we also celebrate diversity and hope more companies in the InsureTech will appreciate the benefits of a diverse workforce and follow Etherisc’s example.

Your Turn!

Stephan shares some very innovative ideas on how blockchain and smart contracts can become freely available and ultimately decentralise the insurance industry.

If you liked this episode please do review it on iTunes. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below. If you’d like to ask Stephan a question, feel free to add a comment below and we’ll get him over to our site to answer your questions.

Thank you Stephan!