Dan Salmons, CEO of Coadjute and John Reynolds, Founder and COO of Coadjute take us through the work they are doing to digitise the real estate industry using blockchain technology. They also explain to us the differences and advantages of using a SaaS (software as a service) blockchain model instead of a consortium one.

Coadjute from Coadjute Ltd on Vimeo.

Dan Salmons is the CEO of Coadjute. His background is a mix of large scale executive jobs in banks, head of innovation and head of strategy and CEO to a number of innovative fintech companies.

John Reynolds is the COO of Coadjute. John has spent the last 20 years working within organisations helping with their digital transformation from Dell, to Fujitsu and Lockheed Martin’s digital arm. What John has learned in 20 years is that digital transformation is partly about technology but it’s really about people’s hearts and minds and business change aspects.

John featured in an Insureblocks podcast on the 30th of November 2019 entitled: “Ep.86 – Real estate on the blockchain – insights from Coadjute”.

What is blockchain?

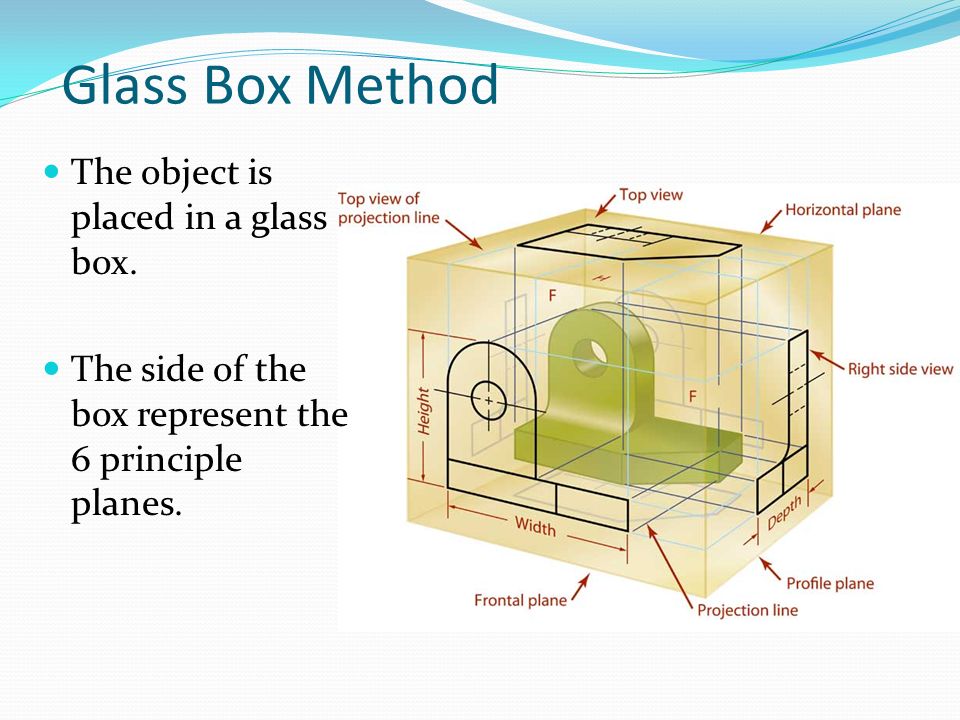

As John gave Insureblocks a definition of what is blockchain in our last podcast, Dan offered his definition of blockchain by using the analogy of the Glass Box Theory.

Dan invites us to imagine that you have a locker room at school amongst others who have their own locked lockers. Imagine you want to be sure that no one has stolen your favourite pair of trainers. The traditional central hub type solution is asking the teacher who has a set of keys that can open everyone’s locker, to go and check if the trainers are still there. As the teacher is trusted you trust that they won’t add or remove items from the locker.

The alternative solution is the blockchain one where you have glass doors on the lockers and you don’t need the teacher to check if anyone’s taken the trainers as everyone can see in everyone’s lockers and verify it. The trouble with that is that everyone can see everyone’s lockers. The alternative solution is a DLT one as the R3 Corda’s where you have two doors, one glass and one metal. In this scenario you can only let certain individuals within your class to open the metal door amongst themselves and you can give them permission to check if the trainers are still there. However, they still can’t access what’s in the locker.

Challenges of the real estate industry

Dan believes that the property industry as a whole, in comparison to other industries, is one that spends the least on technology and on innovation. It does have pockets of innovation and digitisation. For example, whilst sectors of the industry such as estate agents might be digitised, it is not digitised on an end to end basis. That’s where the main problem resides.

The challenge is that every player is using their own internal operational systems and their own CRM systems. What this means is that they’re using their core operational software for the day to day activities within their business but every time they want to connect and interact with someone else they use email or telephone.

An easy way to resolve this would be to build an application, a database or a destination portal for the estate agent, the conveyancer, the mortgage lender and everyone would have a single source of truth. This has been tried but the problem is that every one of those businesses have their own operational software and the last thing they want is another portal. John states that feedback from industry players was that even if a new portal was offered, that was better than the current one and was free, they wouldn’t use it.

The reason for that, is as John states, people forget the cost and effort involved in putting in a CRM system, it is significant as is the time to build the operational processes around it. So, the possibility of getting all the players to rip out all their systems simultaneously and move to a new one is very hard.

Coadjute’s approach to this is by connecting all these systems together. The operational software, the CRM systems, the case management systems, the mortgage origination systems are all connected together. Coadjute isn’t here to build a new operational system but it is about the connectivity for the industry of building that digital backbone.

What this means is that each player doesn’t have to move to email or telephone to interact with each other as they can do it natively within their software. They will have document exchange, messaging, automation and real time update as their software becomes connected to the rest of the marketplace.

Dan believes that this solution will help the UK industry save a billion pound a year in email and phone call chasing. He also believes that another billion is lost in revenues from transactions which take too long to complete. For example, 30% of transactions fall through during the course of trying to get a property bought and sold due to the time it takes to complete.

John believes that since there isn’t a need for multiple millions of pounds to liberate that billion pound in savings, businesses are more open to their solution. Coadjute as a SaaS company is all cloud based and thus doesn’t require any upfront investment. Businesses can try it and use it to determine the level of savings they get out of it. Coadjute removes the friction to new systems adoption by connecting through the existing software as there’s no upfront cost for trying their solution.

SaaS vs consortium model

In Q1 2019, Coadjute ran the Instant Property Network trial with 40 organisations in 23 countries across five continents. Organisations such as Ashurst, Baker McKenzie, Barclays, Clifford Chance, AXA XL, Even, Royal Bank of Scotland, Raiffeisen Bank International, Commerz Real, SBI Nihon SSI, SBI Holdings, BBVA, Search Acumen, Shieldpay, Squire Patton Boggs, Davivienda, Swiss Re and SiriVentures participated in this trial.

In this trial Coadjute was building the application, the user interface and their CRM system. That was their initial thinking point. It meant that each of the players would have a login page into this CRM system. John and his team quickly realised that this would be a mammoth endeavour that would require significant design resources, domain expertise and the need for some kind of consortium. Instead they decided to strip it down right back to the core value and that the existing software companies already had those relationship and what they were looking for was how their software could better serve their customers and connect to the rest of the software in the industry.

Coadjute now consequently simply acts as a connectivity layer, where the software vendors will run the Corda node, and Coadjute will provide the application that allows the connectivity. This allows for a very simply charge on a SaaS model basis. This removes the overheads of setting up a governance model as the software vendors already have the commercial relationship and agreements in place.

To the question on why do these software companies simply don’t use APIs to connect between each other? John believes that software platforms don’t want to spend resources to manage over 50 API connections. He also explains the other benefits that come with connecting to a DLT platform like Corda:

- You get the identity piece which means all the different platforms’ data can be connected together around a single identity (e.g John’s property). It’s like a virtual deal room where all the pertinent data around that property can sit at a very grainular level

- What Coadjute is not doing is acting like an aggregate database where they take all of the information from the different systems via APIs. Software providers retain control of their own data. Coadjute doesn’t see the data, each software provider has their own node and they’re sending data on a peer to peer basis and orchestrating it across a transaction

John also believes there is a migration from complex consortium models, that are slow and struggle to go into production, to one of SaaS businesses. He states how R3 started off as a consortium of banks before becoming an enterprise software company. Just like Marco Polo started off as a consortium before TradeIX moved into a SaaS model.

End-to-End pilot with RBS/Natwest – the startup founder’s perspective

In September 2019, Coadjute built a pilot for a minimum viable ecosystem to connect it along the property value chain. The purpose of this pilot was to prove two points:

- From the back end you can connect all these software platforms to a shared ledger and create this virtual deal room to orchestrate transactions

- At the front end, both from the business users (estate agents, conveyancers, lenders) and consumers there was value in it

What John and his team learned is that for each one of those people, the homebuyer, the home seller, the estate agent, the conveyancer, the broker, and the lender, there was enormous value in both time and cost.

End-to-End pilot with RBS/Natwest – the corporate RBS/Natwest perspective

At the time of the pilot, Dan was the director of innovation for the home buying and ownership division of NatWest. RBS/Natwest had already done a lot of work at trying to improve the home buying process by digitising the mortgage process and improving the experience for customers. However, they were keenly aware that was only two weeks of a twelve-week process for many customers. So there always was this big question about what they could do about the rest of the process?

When Dan met John and the Coadjute team he was intrigued by their solution and by the fact that they were using blockchain. The global trail was intriguing but the pilot simply blew him away. Each participant of the pilot could see how this technology could halve the length of time it takes them to do what they’re doing.

From a bank perspective one of the key successes of Coadjute was being able to bring the industry, senior representatives from estate agents, surveyors and conveyances to the big banks. The pilot didn’t just demonstrate that the technology worked but it demonstrated the real value Coadjute had in bringing the industry together.

For Dan this Corda based solution was really workable, tangible, robust, secure and you could see it functioning. It didn’t have the feel of a pilot solution and you could see the steps needed to industrialise the solution. Dan was so impressed he decided to join the company.

Coadjute’s progress in 2020

Dan states that since Coadjute’s last podcast with Insureblocks in November 2019 it has changed beyond recognition in some ways but has kept true to its core values of collaboration, innovation and trust. Internally they refer it to as if they have evolved from a project to a company. They have expanded their team which Dan now leads.

In June of this year they announced their first launch partners: Redbrick, MRI and Dezrez. They’re now constantly working with the software players to see how they can further integrate their solutions within Coadjute and how they can jointly work together to bring new solutions to the market.

Coadjute is now busy in fundraising activity as they prepare to launch a new version of their solution by the end of this year / beginning of 2021.

Effect of COVID lockdown on the property market

During the lockdown in the UK, Coadjute initiated a weekly Property Market Insight report as they’ve got 50% of the estate agents in the market and they could report exactly what was going on in the market. The reports demonstrated a V shape recovery that happened amazingly quickly after the lockdown with a great bounce back with buyer registrations and sales enquiries bouncing to a level before the pandemic arrived.

Dan believes that the fact people where stuck in their property during lockdown gave them the time to rethink what they want out of a property such as getting an extra bedroom or live someplace where it is easier to go out for a nice walk.

From his side, John points out that COVID has brought forward the real need for digitisation and automation of low level tasks around following up and chasing up events. John states that yes we can work remotely and we can automate things by connecting up all the industry’s software systems.

Vision for Coadjute

For Dan, Coadjute has a very simple vision which is that one day, it will be really easy to buy and sell property. It won’t be this complex, opaque chore and expensive to operate that it is today. He also states that once Coadjute has provided this digital connected backbone infrastructure to the industry then it’s possible to provide many services that today are quite difficult to do because the market isn’t connected. An example of that is identity, KYC, which is repeated in lots of places and there’s no easy way for any of the players across the value chain to check a customer on behalf of the rest of the industry.

In addition to the value of its technology, Coadjust is also about bringing the industry together and acting as a catalyst for developing new innovative solutions.

___________________________________________________________________________________________

This episode is brought to you by our friends and sponsors at R3. In this digital-first world, now more than ever, businesses need to modernize existing processes, systems and models – and enterprise blockchain provides the ideal solution for transacting directly and streamlining business operation.

Developed by R3, Corda is light years ahead of other blockchain platforms in terms of privacy, security, scalability and interoperability. And–because Corda was built to meet the stringent requirements of highly-regulated industries, it can be used by firms of any type or size and in any industry.

Blockchain applications built on Corda can reimagine and increase the potential of existing business networks, enabling direct and trusted transactions that eliminate friction and accelerate growth.

Check out r3.com to find out more.