Today’s episode takes us to New York with Bill Pieroni, President and CEO of ACORD, the global data standard setting body for blockchain in the insurance and related financial services industry.

Bill shares his perspective about the importance of the uniform data standard provided by ACORD and the value of investing in blockchain and new technologies.

Blockchain in two minutes

A blockchain is a digitized, decentralized ledger of transactions.

The first step is a transaction request, such as a claim, contract or endorsement. This request goes over a peer-to-peer network and, after its validity is verified through cryptographic algorithms, it is combined into a new data block which is added to an existing blockchain, thereby completing the transaction.

In insurance, the peer-to-peer network can be comprised of insurers, reinsurers, brokers, independent agents, regulators or anyone with a vested interest in the insurance industry.

ACORD

ACORD is the global standard setting body in the insurance industry. It aims to bring together various stakeholders for whom collaborating would otherwise be difficult, either because they are competitors or because they lack the necessary infrastructure. For over forty years ACORD has been providing the infrastructure, facilitation and expertise to enable fast and accurate data interchange by creating electronic standards, standardised forms, taxonomies and tools. It boasts over 8,000 global members, with one third of all global premiums leveraging ACORD standards covering brokers, agents, carriers, reinsurers and solution providers.

With new technologies such as blockchain, IoT and usage-based insurance, data standards have become more important than ever. Investing in innovation runs a risk of becoming a one-off investment due to an inability to effectively leverage the technology. By setting a common data standard across the industry, ACORD helps lower the cost, risk and time associated with investing in innovation.

ACORD and blockchain

A great aspect of blockchain is that it requires a level of cooperation which brings together the stakeholders in the insurance industry. Operational efficiency is blockchain’s most popular feature. However, Bill reminds us of blockchain’s potential to enable the development of superior value propositions. Talented individuals across the insurance industry can work together to focus on meaningful differentiation rather than just thinking how to compete on price based on a specific set of data.

Following a proprietary approach to data standards would be a mistake. It would create barriers in the industry by limiting a product’s uptake and the the availability of vendors to develop innovative solutions.

Having a common data standard is therefore critical. It reduces risk and makes it easier for existing legacy platforms to adapt to blockchain. A common data standard does not only create a tactical advantage, ie cost reduction, it creates a strategic advantage as well. ACORD standards leverage much of the work done in the insurance industry in the past decades and share that with ACORD’s global network.

ACORD is involved in most, if not all, blockchain initiatives globally, either by helping develop their data standards or by directly leveraging ACORD standards as part of the initiative. Here at Insureblocks we have seen quite a few of these initiatives. Insurwave, B3i and R3’s Corda blockchain all utilise ACORD standards. ACORD is also working with different digital network operators, including B3i and the RiskBlock Alliance, to create a smart contract standard on how data is processed, a key step in allowing interoperability between different networks. Finally, ACORD is working with Ethereum and IBM’s Hyperledger Fabric as it seeks to set a uniform data standard across blockchains.

Data in the insurance industry

Data is the lifeblood of the insurance industry, which fundamentally works by examining data to quantify risk. While insurance companies have been doing this for hundreds of years, digital data requires a different approach. ACORD has created a digital maturity model as part of its white paper on the insurance industry’s digital maturity, which is freely available for ACORD members here. You can also read more about the study here.

The model ranks digital data maturity in five stages:

- Analytically impaired: companies at this stage are dominated by standard reporting and maybe some ad hoc reporting. They use data to ask backwards facing questions, such as why did a loss occur or why did growth not match expectations.

- Localised analytics: these companies have some ad hoc reporting and queries and tend to focus on how they can use the data to improve.

- Analytically aspiring: they might have passive alerts and some statistical modelling. These companies use data to predict how the industry will develop and move forward.

- Analytical carriers: they use forecasting and predictive tools to innovate and differentiate themselves.

- True digital competitors: these companies ask what is the best possible outcome and seek how to best utilise data and highly leverage predictive analytics across the insurance value chain.

Bill stresses the importance of leveraging data to create a competitive advantage. Using data to look backwards and ask what happened is not a strategic use of data. Companies should ask how data usage can be optimised to lead to the best possible outcomes.

ACORD’s study found that only 10% of insurance companies are in the top category, with another 10% falling in the second. The good news is that only five to ten percent are in the bottom category. What Bill is most concerned about is the middle grouping, which includes over a third of all insurance carriers. While these companies are investing in optimising their digital data, this can be a costly and difficult journey.

Blockchain in the insurance industry

Analytical carriers and digital competitors, the two top categories of the digital maturity model, are two to three times more likely to be using blockchain. As a whole, however, the insurance industry has been hesitant towards blockchain. Bill gives us two reasons for this:

1. Legacy technology

Perhaps surprisingly, the insurance industry was one of the first adopters of technology in the late 1960s to early 1970s. This has led to a great deal of legacy technology which makes it more difficult to leverage new technologies.

2. Risk aversion

The insurance industry avoids risk. Despite the fact insurance companies quantify and cover risk, they seek stability and consistency by managing, codifying and transferring that risk. Part of this involves examining past performance to calculate premiums. This practice has made insurers more conservative and has created a negative feedback loop which does not incentivise risk-taking behaviour. Coupled with the fact that insurance is a very compliance and regulatory driven industry, insures have both real and perceived barriers in utilising new technologies like blockchain.

This hesitancy, however, comes with a very real risk itself. Many companies will be unable to catch up with blockchain once it takes off.

This hesitancy, however, comes with a very real risk itself. Many companies will be unable to catch up with blockchain once it takes off. Last generation technologies, such as the microwave or television, had a latency period of anywhere between ten to thirty years and once the uptake occurred the CAGR (Compound Annual Growth Rate) was 4%.

Things are different now as there is no latency period. A new technology is introduced, examined and then quickly adopted or discarded. If companies don’t embrace these technologies, experiment with them and become part of the learning curve, they risk missing out. Adopting new technologies, including blockchain, is about informational scale economies, instead of operational. Some blockchain initiatives will be unsuccessful but will still constitute a learning experience. Late adopters, on the other hand, will be at a disadvantage as they will miss out on the knowledge on how to optimally utilise blockchain.

Why companies can’t play catch up

A common response is that many companies cannot afford to invest in unproven technology. They would rather wait to see how blockchain develops and then spend extra money to hire experts to help them catch up.

The problem with that argument is that it misunderstands the nature of blockchain. Large teams are not well-suited to new technologies and spending a lot of money and resources to catch up with blockchain is neither necessary nor effective. What is necessary is to have a small and highly skilled team of three to five people thoughtfully examine blockchain to understand the issues, opportunities, and strategic and tactical implications. This is a long term objective and not investing in new technologies may dissuade this talent from ever joining a company, which is one of the reasons insurance commonly appears in the bottom quartile of attractive industries for young people.

To draw an example from the finance industry, Commerzbank is currently experimenting with five different types of blockchain. While this is taking things to the next level, it illustrates how adopting blockchain is a long term effort seeking to enhance a company’s knowledge.

Technology investment and shareholder returns

In the blockchain for insurance summit Bill gave a persuasive explanation on the correlation between IT investment and total shareholder returns. The study examined a few thousand carriers over a twenty year period and tried to identify whether the level of IT spending correlated to total shareholder returns.

At face value there is no correlation between IT spending and shareholder returns. However, the team confirmed that if IT spending is aligned with strategic intent, business processes and organisational attributes and capabilities, a strong correlation with shareholder returns is clear.

IT spending needs to be done thoughtfully as part of an overarching strategy. This includes focusing on the product, focusing on customer-relationship management, innovation, operational efficiency and price based competition. Companies that successfully align these objectives with IT investment have some of the highest customer satisfaction and retention levels and achieve superior loss cost, which averages over 70% of premium dollars for property and casualty and non-life insurance. The correlation coefficient between level of IT spending and the ultimate impact on shareholder returns becomes well over 0.9.

ACORD and blockchain investment

One of the objectives of ACORD is to help members invest in blockchain and other new technologies.

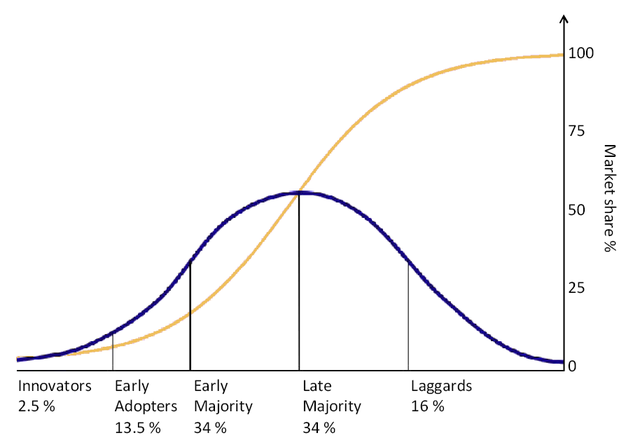

Looking at the diffusion of innovation curve, we can see a trigger, a peak of over-inflated expectations and some depression. Expectations and results vary greatly when investing in new technologies.

ACORD examined over 600 successful and unsuccessful technologies in the insurance industry over a 20 year period to create a framework for examining whether new technologies like blockchain will be successful:

- At the core of this framework is the anticipated and actual captured value, ie how much value the technology was expected to create and how much value it ended up creating.

- Can the technology be tested? Technologies that do not allow for experimentation and testing because they require users to discard much of their legacy technology tend to fail regardless of whether they would have created value.

- Do the decision-makers believe it was the technology in question that led to the improved result? The insurance industry depends on numerous factors, such as weather and the economy. It needs to be clear that it was the technology that added value.

- Is the technology compatible with legacy technology? Technologies and innovations that require replacing a lot of infrastructure tend to be unsuccessful.

- What is the level of homogeneity between users? Users of successful technologies use it in a consistent way.

- Is there coopetition? Competitors coming together to make the technology useful is a good sign.

- Are there authoritative adopters? Successful technologies tend to be adopted by firms within the industry which are respected in their given areas.

Bill stresses that these criteria are necessary but not sufficient. The laserdisc fulfilled all the criteria and had superior image to the VHS but that didn’t take it very far. Nevertheless, we are happy to see blockchain fits all the criteria.

Your turn!

Bill gave us some great perspective on the importance of common data standards and how to best approach blockchain and other new technologies.

If you liked this episode please do review it on iTunes. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below. If you’d like to ask Bill a question, feel free to add a comment below and we’ll get him over to our site to answer your questions.

Thank you Bill!