In this fascinating episode we are joined by Andy Martin, Blockchain Business Design at IBM. For the last three years Andy has been working on how to create business case for blockchain networks. In this podcast he shares with us his deep wealth of experience in how to design effective blockchain business design. This is a must listen to anyone interested in establishing blockchain networks.

What is blockchain?

In defining what is blockchain, Andy focuses on private permissioned blockchain whose initial opportunity is in optimising shared business to business processes. Up to now the approached businesses took was in having a central intermediary to act as a central database to smooth out that shared process. The challenge is that both the quantity and the value of data has been growing very rapidly, leading to reluctance in businesses to share that data to a central intermediary.

Blockchain gives us a super elegant approach to sharing this process across the members of an ecosystem in such a way that no one person is in charge of the data. All the members can have a say in how that data is governed and they each have a copy of the ledger. Smart contracts are running on top of it and that is where the shared processes have been codified – who needs to do what to move the status of an asset as it moves across that shared process as trades of ownership of that asset are made. When a trade of ownership transaction is proposed to update the ledger, a consensus mechanism is used, so that all the members of the network can come into agreement as to what is the status of this asset as it as it moves through this process.

Blockchain has created a new asset which is trusted data at the level of the market. Privacy controls are put into place so that only the permissioned individuals are allowed to see the data. This new asset is effectively the foundation stone to truly innovate, to create new types of business and new types of marketplaces. This paradigm shift provides players within an ecosystem an interest to collaborate with their competitors in building that trusted data marketplace to then compete above it whilst combining your firm’s private data and capabilities and combine it with that trusted data.

Building business cases for blockchain networks

There are three big areas where building a business case for a blockchain network is different than any other technology:

- Incentive model

- Network effect

- Market level thinking

For any blockchain network you also will need an effective governing body that plays the role of defining the marketplace rules. It needs to be fair and democratic to ensure that everybody gets a fair chance and cut of things and a desire to increase the volume of transactions within that market.

Incentive model

Three different types of business cases have to be built to create an incentive model. Each of these business cases have to interrelate and create reinforcing behaviour:

- A solid financial incentive for whatever entity who is going to be bring this network to market.

- A strong business case for each of the members of the network to join it. If members benefit greatly from the network you charge them a fee to join it. Some members may be so valuable to the network that they either have great gravitational pull that they can bring other members to the network or whose data is so valuable that you may choose to give them free access to the network.

- The final case is for those who provides useful data to the network but don’t benefit greatly from being in the network. An incentive model is required for them to join the network.

Network effect

The whole point of the incentive model is to ensure that as many of the trading partners of a market join a blockchain network. The incentives are here to identify and recruit the partners who can bring the most transactions and volumes to the network in order to seize a market. This will in turn enable to help all network participants to innovate on top of that new marketplace.

Andy is quick to clarify that when he talks about network effects he isn’t talking about Facebook. With Facebook you have a single governing identity that is controlling the data. In a blockchain network there isn’t one party that is owning and driving the governance and monetisation of the data.

Market level thinking

The third point regarding blockchain network is to be thinking at the level of a market. These markets will be driven by zones of regulation, for example one in the EU, one in the US and one in Asia Pacific. Because these are networks for businesses they need to be compliant to the local regulation.

Effective governance

The governance is all about designing an incentive model to drive helpful behaviour from all of the various interest groups on the network to drive the volume of transactions up through the network. It’s critical for a governing entity to be fair, where every participant has a fair incentive to want to join and get a fair sharing in the benefits of being part of that network.

If that is achieved we need to make it as simple and as easy as possible to move a business onto the blockchain network. That is why in Andy’s opinion we need to start with a very thin layer of blockchain that initially focuses on the shared processes. In automating the paper processes, the phone calls and Excel spreadsheets. Additionally, it has to be commercially attractive to join the network, it has to have an easy onboarding and immediate first benefits, making it easy to consume the service.

Andy gave us an example on the important of having a good effective governance model through a case study of 31 banks in Australia who created a financial network together.

The top three or four banks in the network probably have something like over 50% of the market share. The aspirations these banks had was to create a marketplace utility. They engaged with the local regulator who made it clear that the 31st bank that signs up to the network isn’t disadvantaged compared to bank number one. The governance structure used to regulate that network was made to ensure that all banks weren’t disadvantaged when joining the network compared to the original founding ones.

Five laws of blockchain business model design

These five “laws” or ideas came to Andy whilst having lunch in Nantwich and what they represent are the five core principles one needs to consider when building a blockchain business model:

- Rule 1: Network entities sell digital products and services created through ecosystem collaboration

- Rule 2: Sales increases with network effects within one market or by building new markets with new data combinations

- Rule 3: Governance of incentives creates helpful reinforcing behaviours

- Rule 4: Governance enables transition from a central start to a fully decentralised marketplace

- Rule 5: Governance enables the Token or Network Economy

Rule 1: Network entities sell digital products and services created through ecosystem collaboration

The first law is about creating new digital products and services. And we’re looking to expose these on a marketplace.

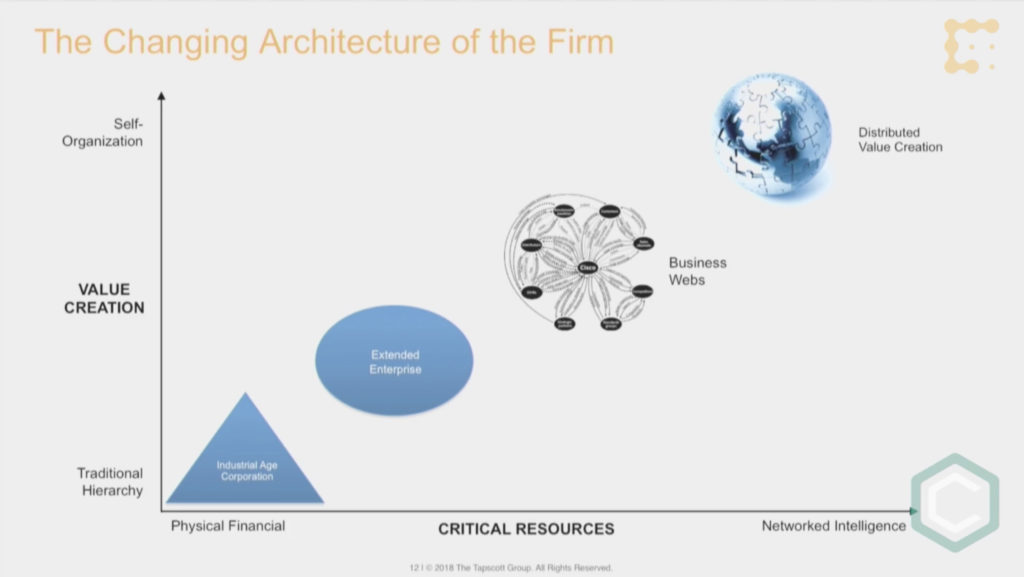

Andy references a speech by Don Tapscott where he mentioned that we were seeing the birth of a new type of business that looks more like a network. There are numerous special purpose vehicles for creating a blockchain network. In the above case of the 31 banks a for profit company was created by the four or five founding members to take this network to market. Other markets may take a different approach such as using a non-for-profit consortium. An alternative approach is one where a technology solution provider who is building the capability and taking that to market to build an ecosystem around it.

The fourth model is one where you have a dominant player within a market who chooses to launch a blockchain network.

In this instance it is critical to have a governing board that will fairly represent the interest of the key players in the market. This is the easiest and fastest approach to launching a blockchain solution.

According to the 2nd Global enterprise blockchain benchmarking study, 71% of live networks have been initiated by a single founder leading the initiative.

Within the insurance industry we have seen RiskStream Collaborative take the not-for-profit consortium approach, B3i take the for-profit approach and Insurwave the more dominant player model.

Rule 2: Sales increases with network effects within one market or by building new markets with new data combinations

Network effects are created by either picking up existing trading and capturing that in a marketplace, or by creating new types of trading. Blockchain networks provides the opportunity for creating new trading relationships by bringing in new data and new member types into a network. This drives new types of transactions. It has a governance model that ensures that everyone can govern their data and that the marketplace works on democratic and fair principles.

In creating a marketplace for peer to peer trading there are two models:

- “As is model”: These are existing peer to peer trading relationships that are added to a blockchain marketplace to put onto a share process to automate and reduce friction. This is about creating the foundations to reinvent the industry in new markets.

- “New market models”: creating new types of trading relationships with new types of data combinations. This can be done in two ways. One way is to start with a blank sheet of paper that brings member types that wouldn’t normally trade together to create a new value proposition. A second way is to take the “As is model” and inject it with some new data to drive new trading relationships to drive some new network effects.

Rule 3: Governance of incentives creates helpful reinforcing behaviours

The third law is about having a governance model that creates a fair incentive model for all the marketplace participants. Theses incentive models can take the form of cash or more elegant solutions to generate a helpful behaviour for all participants.

There are a set of levers a governance function can pull to design the incentive model:

- Operational improvements participants get by being part of a blockchain network

- For a for-profit model you could have the rule of five, where the first five members who are starting to form the marketplace may have slightly higher privileges that the second and third set of five members in terms of equity ownership of the business for example

- For a not-for-profit model you could still follow the same sort of five by five but the first five who are putting some money in their pocket to help build out the marketplace will get access to some privileges. For example, if an innovative new service is going to be added the founding members will get exclusive access to that service for a period of three months before the other members. Or perhaps they will get a lower access to the cost of the basic services of this marketplace for a period of time until they get their money back.

Rule 4: Governance enables transition from a central start to a fully decentralised marketplace

In Andy’s opinion for a marketplace to grow it needs to get progressively more decentralised to do that, because there’s a power equation here. If the network remains too centralised within the hands of too few people, having access to the governing entity, then the incentive to collaborate starts to fall away. Finding the right level of decentralisation can be tricky and can be different depending on the marketplace.

Andy quotes Joe Lubin who stated at Devcon 5: “But I think it is short-sighted when some people believe that all blockchain systems must be fully permissionless and maximally decentralized. When you are issuing valuable assets or anchoring into a base trust layer, that layer must be maximally decentralized and that requires it to be completely permissionless. But adding some decentralization to use cases that are enacted among a small set of counterparties is enormously valuable, and this is best done on a private permissioned system.”

In a private permission network, the opportunity is to seize a market. For that to happen it is ideal to have the main players of that market join the network leading to an early centralised approach to that network. The key thing to determine here is how important is that long tail? If it is important, you will need to have a governance structure that is open and fair enough to incentivise new members from that long tail to join the network to seize that market.

It is thus important from the get go to determine the level of decentralisation the network wants to aim for. Will it have a coopetition model that is open to competitors joining and to the launch of new competing value propositions.

Rule 5: Governance enables the Token or Network Economy

Tokens are part of the new set of tools and techniques that a governing function can take advantage of for driving trade and for driving collaboration. Tokens have three high level jobs on a blockchain:

- A means of payment whether it is in fiat or crypto

- Ownership whether it is for a digital asset or a physical asset that needs a digital twin

- Utility token

Utility token

In creating a marketplace that will have a whole range of service, you need to attract a number of participants in order for them to transact correctly onto that marketplace. What are the tools a governance function can have to create a really smooth marketplace to try to encourage behaviours right at the beginning?

Outlier Ventures have helped Andy to inform his view on the function of utility tokens as an economic level for the governing entity to control marketplace behaviours. There are three levels that need to interact:

- Marketplace level – encourage participants to consume services on the marketplace

- Ledger level – encourage participants to build innovative new digital products and services

- Governance level – design the economic model behind the token. This is useful for controlling behaviour where mining tokens or staking tokens are commonly being used in todays networks.

Example: Plastic Bank

The Plastic Bank is Andy’s all-time favourite blockchain network. Plastic Bank was founding in March 2013 in Vancouver, Canada by David Katz and Shaun Frankson. David was alarmed by the amount of plastic he could see around him whilst scuba diving. After some research the duo came to realise that the majority of the plastic that ends up in the ocean comes from a relatively limited number of rivers in developing countries.

The challenge they set themselves was how to design a business model to change the behaviour of folks living near beaches and near rivers to turn them into recycling entrepreneurs.

The Plastic Bank is a for profit company that aims to monetise waste plastic and turn it into currency.

The idea is that you have various collection points on beaches or near rivers. These collection centres are going to recruit recycling entrepreneurs, who will take the collection bags and collect plastic and bring them back to the centre to turn them into “Social Plastic”. Social Plastic is Plastic Bank Verified plastic that provided a premium for the collector. The premiums are called Plastic Bank Rewards. These rewards are distributed and authenticated through the Plastic Bank app which uses Blockchain technology to provide the safest and most trusted means to deliver a globally scalable social impact.

Recycling entrepreneurs who bring their plastic bags to the collection point get paid in tokens which goes onto their phone’s Plastic Bank app. These tokens can be redeemed with local service providers. So the Plastic Bank has become basically the largest shop in the world for the poor. These tokens can be used to pay for school fees to pay for heating oil and for many other services.

In turn leading consumer packaged goods and leading retailers who wish to enhance their brands can then sell their products using social plastic. What these firms needs is an ability to trace the provenance of this social plastic which is what blockchain technology enables them to do.

This creates a virtuous circle of behaviours that are driven by this utility model, whereby the behaviours of the retailer, the behaviours of the service providers, the behaviours of the recycling entrepreneurs, and the behaviour of the plastic bank itself, all pointing in the same direction, and all driven by this utility token.

The fascinating opportunity about this model is that by turning the plastic collectors into entrepreneurs you start having a trend business where you can start finding a trend in the amount of plastic they bring to the collection point every week, to which you can lend against. This drives micro finance. So, the Plastic Bank actually is a means of establishing identity for the unbanked, a means of cleaning up the environment, and a means of driving innovative new finance into developing markets.