Today with us we have Susan Holliday, Principal Insurance Specialist at the International Finance Corporation (IFC), all the way from Washington DC. Susan has over thirty years of experience in the insurance industry and specializes in insurance and insuretechs. We will be discussing how to unlock the future of blockchain and the opportunities for insurers in emerging markets.

Blockchain in two minutes

While there are different blockchains with slightly different features, blockchain is centered around two key features:

- It is a distributed ledger. This means it has numerous nodes and, if one part of the blockchain experiences an error, the rest of the blockchain remains operational.

- The transactions are processed in blocks. Each block is linked by a hash (a cryptographic function) and is immutable. This means it is completely transparent and users can trace every transaction.

The International Finance Corporation

The IFC is the World Bank’s private sector arm. It is government-funded, with nearly all governments of the world being shareholders of the IFC. Its goal is to invest in emerging markets to alleviate poverty and increase shared prosperity. It achieves this by considering both the financial returns and the developmental potential of a prospective investment. The IFC helps companies grow and brings in private sector investment. Following a project’s completion, it exits its current investment and uses the profits to continue its work in other areas.

Insurance plays a fundamental role in achieving the IFC’s goal by helping companies and individuals become more resilient. People can then establish businesses more easily, take on risks and better cope with the financial difficulties of a natural catastrophe or a death in the family.

The IFC works within all classes of insurance. It has invested in commercial line companies, reinsurers and personal line companies including non-life, life and health. Insuretechs are also becoming an increasingly important part of the IFC’s portfolio.

Insurance penetration in emerging markets

One of the challenges of emerging markets are the very low insurance penetration rates. While there are protection gaps everywhere, insurance penetration, which is measured by premiums versus GDP, is typically lower in emerging markets.

There are three main reasons emerging markets have low insurance penetration rates.

1. Natural catastrophes

Some emerging markets are exposed to various natural catastrophes for which they are largely uninsured. This is an increasingly big problem and the IFC is actively looking to provide solutions to climate risks. However, this is not the root cause as countries with a higher insurance penetration can also have a high catastrophe exposure.

2. The insurance trust deficit

In many emerging markets people are either unaware or distrustful of the insurance industry. Some of this distrust stems from historical examples of companies writing business with no intention to pay out valid claims or intermediaries who defrauded clients. Part of the blame, however, rests with the current state of the insurance industry. Products developed over fifty years ago are not well-suited to the needs and day-to-day problems of people in emerging markets.

The solution to this is customer-centricity. Companies need to pay more attention to the needs of clients to develop new and better-suited solutions.

3. Profitability

Disposable income is, on average, lower in emerging markets. This means coverage and premiums would be small, which doesn’t sit well with insurers’ high operating costs. Even where claim ratios are low, high operating costs and too many middlemen lead to disheartening results for insurance companies.

The IFC is trying to change that by investing in fintech and insuretechs to create new products that can be delivered in a cheaper, more efficient way. By investing in new technologies such as blockchain, artificial intelligence and machine learning the IFC hopes to automate parts of the insurance process so that insurers will be able to handle high-volume, low-margin business.

Opportunities in emerging markets

Emerging markets are ripe with opportunity for insurance companies. Unlike other markets, it is about growing the industry rather than fighting for market share.

1. Underserved population

Most insurance in emerging markets consists of larger companies that provide insurance for themselves and their employees. This leaves a large gap of underserved potential customers. Emerging markets have a lot of SMEs, which are often too small to have group policies. There is also a large informal sector where people are, in essence, self-employed. Both these groups have traditionally been hard to reach and provide the right product for.

There are also some particularly underserved markets. Susan is involved in a project aiming to provide better insurance offerings for women, and in particular women-led SMEs, demonstrating the financial inclusion aspect of the IFC.

2. Leapfrog potential

While there are great examples of emerging markets efficiently using technology, such as Kenya’s M-PESA, emerging markets are still behind in adopting technology.

The advantage of this is that emerging markets can more easily adopt the technology best-suited to their needs. In a previous episode, Bill Pieroni, President and CEO of ACORD, talked about how legacy technology can be a challenge in adopting new technologies. In emerging markets, however, insurers, don’t have to go through all the old business models. In many cases, the people in these markets have never had a landline or a personal computer. This isn’t stopping them from innovating and cheaper smartphones are making innovative services accessible to a wider portion of the population. For example, consumers in India can transfer money using WhatsApp.

This potential has created the opportunity of building the insurance companies of the future. Insurers can skip some of the evolution US and European industries have gone through and cater specifically to the needs of emerging markets.

How can blockchain help unlock emerging markets for insurers?

Blockchain is well-suited to simplifying aspects of insurance involving multiple parties and can help insurers access emerging markets.

1. Bancassurance

Due to the large number of parties involved, including a bank, the client and other intermediaries, bancassurance can be complicated and unnecessarily costly. Blockchain can simplify this process and make bancassurance more cost-efficient.

2. Health insurance

To create health insurance policies which are affordable and cater for emerging markets, the whole value chain needs to be readjusted. This includes patients, customers, doctors, hospitals, pharmacies, insurers, clinics and more. Susan believes blockchain is the right tool for the job and that it will have the biggest impact in health insurance.

3. Parametric insurance

Blockchain and smart contracts are great for handling real-time information and automatic payouts. Examples of parametric insurance include weather events and flight delay compensation.

4. Traceability

Blockchain’s traceability could be a way of reducing fraud and making public records more accessible. Many emerging markets have no public records databases. Putting public records data on a blockchain would make it easily accessible and reduce transaction costs. For example, the details of cars, their license and insurance policies could be easily accessible to all insurance companies in a market.

Another important application of blockchain’s traceability is healthcare, where it can improve the supply chain management by tracing the origins of pharmaceutical products. There have been scandals in numerous emerging markets in which expired medication had been provided to consumers. Without blockchain it is often very difficult to trace its origin and find the party at fault.

5. Trust?

It is easy to assume people will automatically trust blockchain. Insurers must be careful, however, especially in the beginning. In markets where insurance is already met with distrust, blockchain can be seen as an added complication. Susan believes companies shouldn’t make blockchain a big selling point to the consumer. It is the better service and customer-centricity blockchain provides, not the blockchain itself, that can increase trust in the industry.

Micro-insurance

“Micro-insurance”, which is becoming increasingly popular in emerging markets, can actually refer to two different types of insurance.

- The original use of the term refers to low-value insurance for people with lower incomes, similar to how microfinance refers to low-value loans for people with lower incomes.

- It can also refer to very short-term, on-demand insurance. However, it is important to remember that the distinction can be sometimes hard to draw. For example, a customer might require low-value, short-term insurance to travel to a different city.

Blockchain can help facilitate both types of micro-insurance. Smart contracts (about which you can learn more here) can make low-value insurance more efficient and reduce costs, making it a more attractive offering for insurers. Blockchain can also improve on-demand micro-insurance by utilising real-time information in combination with smart contracts to create a more efficient service.

Blockchain use cases in emerging markets

Susan was happy to share some of the blockchain use cases she has encountered working in emerging markets:

- Bluzelle is a company working with insurers to create real-time claims processing.

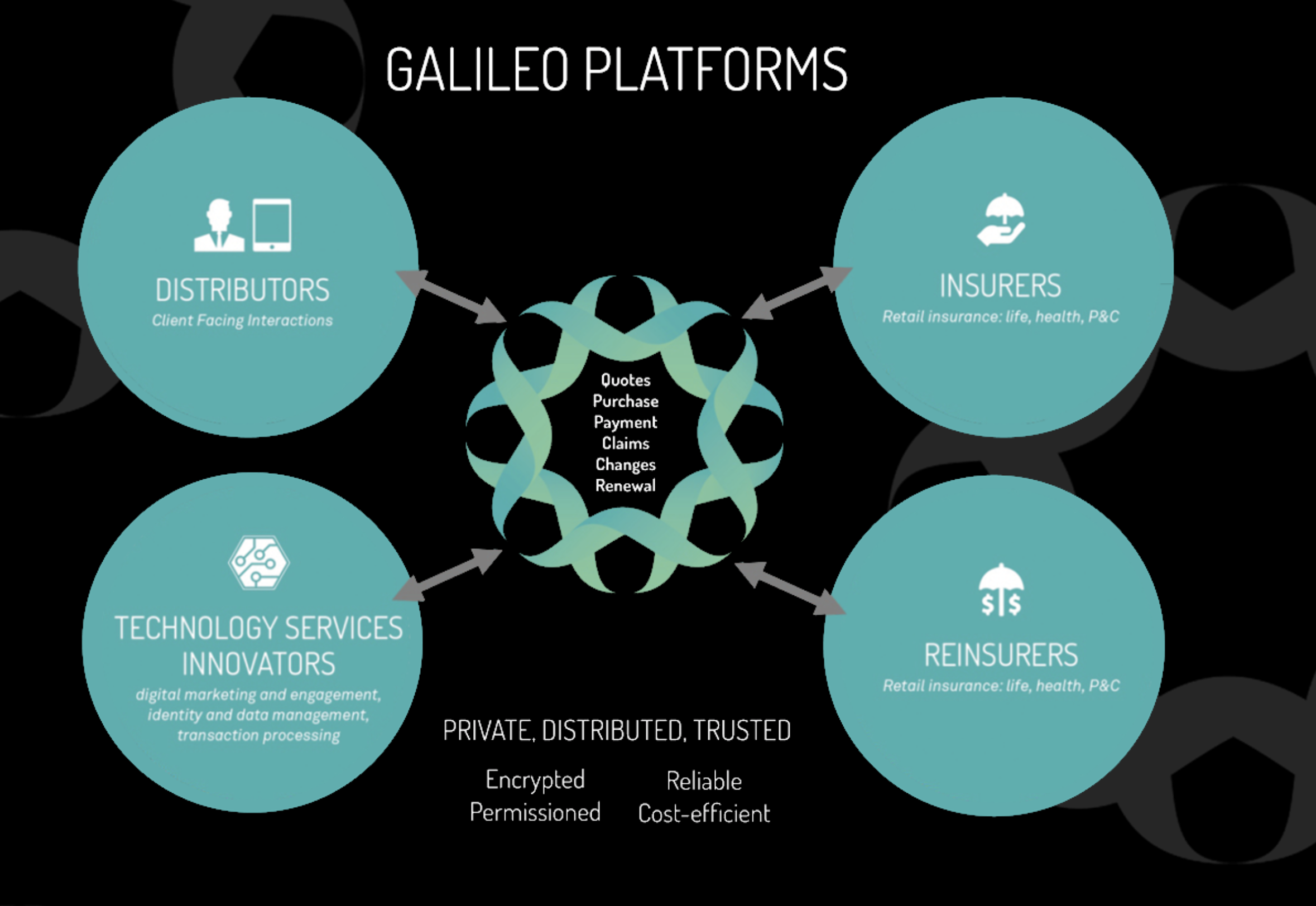

- Galileo is creating a blockchain ecosystem which includes banks, insurers, reinsurers and service providers.

- StaTwig is focusing on supply-chain management, integrating blockchain with IoT.

- Inmediate, which features in one of our previous episodes, is the first digital broker in Singapore. They operate a b2C platform for retail insurance and a b2b insurance technology distribution business.

Blockchain: the way forward

Blockchain is here to stay and has lot to offer to the insurance industry. However, some issues need to be resolved before unlocking blockchain’s full potential.

1. Education

Blockchain is still a buzzword. While people are learning more about blockchain every day, “blockchain” is still thrown around too much without people fully knowing what it means. The insurance industry must experiment with blockchain and educate itself to use it in the most efficient manner.

2. Narrowing down the options

Blockchain is still a rapidly evolving space. Insurance companies are experimenting with different implementations and there is still a debate about whether blockchains should be open, closed, permissioned etc. This is necessary so that blockchain can improve and insurers can learn what works best for them.

However, the industry has to narrow down its blockchain options to a smaller number of models and market winners before blockchain’s wider adoption. Smartphones, for example, primarily use Android and iOS. It is not realistic or efficient for insurance companies and their clients to be working with a vast number of different blockchains. Groups like B3i and the RiskBlock Alliance, which both feature in previous episodes, are working on this by consolidating the market and making cooperation easier.

Which blockchain initiative has caught your personal attention?

Susan is still yet to see her ideal initiative focussing on health insurance, stating the complexity behind incorporating multiple parties as the reason for its delay in development. However, as discussed in Ep.14 – Blockchain use cases outside of insurance with Lee Brenner, initiatives such as MediLedger are showing progress in this space, bringing medical records into the 21stcentury.

Your turn!

Susan provided a great analysis of blockchain’s potential and the opportunities for insurers in emerging markets.

If you liked this episode please do review it on iTunes – your reviews make a huge difference. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below.

Thank you Susan!